Intuit Mint offers a robust established of automated applications for tracking your particular finances. Amongst individuals applications is the one that makes this just one of the very best budgeting apps we analyzed: The ability to make numerous budgets to perspective your expending across diverse groups.

Element of Intuit’s secure of monetary solutions — which incorporates TurboTax and QuickBooks — Mint has been around due to the fact 2006. Mint’s expert services are no cost, but at minimum 1 element (bill negotiation) has an extra fee, and you are going to have to endure a constant food plan of monetary presents.

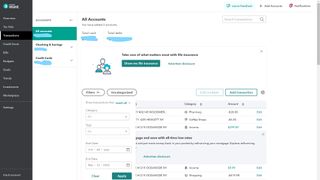

Mint tracks your paying out, supplies fiscal alerts, and consists of absolutely free credit score monitoring from TransUnion. When you url your financial accounts, you can set up a budget that attracts on that facts and track your transactions and financial wellbeing from a solitary dashboard. (For this Intuit Mint critique, we are focusing on the total usability and budgeting capabilities.)

Intuit Mint critique: Value

Intuit Mint is free to use, but in exchange for its solutions, Intuit serves up a barrage of economical provides the products and services matched to you. These provides vary from ads for other Intuit solutions (like TurboTax) to credit score playing cards, loans, and more. On cellular, those people ads can be eliminated if you pay out $.99 for each thirty day period and on iOS you can subscribe to Mint Premium for added attributes for $4.99 per thirty day period. Advertisement-free or Premium subscribers will see no advertisements further than the Mint Market through the net-based provider (but bizarrely you can’t initiate the advert-cost-free practical experience from the world wide web).

Mint is the only service we reviewed that has an individualized economic coaching package deal accessible at an extra charge. Mint implies spending $125 for those people two periods, but it also promises you pay out “what you imagine it’s worth” when you schedule the second session.

Intuit Mint evaluate: Attributes

Mint is a full-spectrum particular finance application that utilizes device studying to make fiscal recommendations. Provide Mint with details either manually or by linking banking, credit card, and investment accounts, and the support offers a functioning see of your financial wellness and routines. As with Intuit’s TurboTax support, Mint connects to much more than 20,000 regional and international monetary institutions.

The company parses the info you’ve supplied into actionable and practical categories, providing a image of your expenses, transactions, credit rating, budgets, ambitions, tendencies, and investments all beneath just one-roof. It can also monitor your subscriptions and bulk edit transactions. And it delivers useful visuals for viewing and parsing developments for investing, revenue, assets, money owed, and web worth. Mint also supports tracking cryptocurrency investments.

Intuit Mint evaluate: Accessible aid

From within just Mint, you will get incredibly little in the way of advice or economic schooling. The Mint lifestyle website on-line has plenty of article content and information, but you want to look for that out individually, outside the house of the support itself. The cell app has backlinks to Mint life, and a how-to-use tile that one-way links out to Mint life, but which is about it. Intuit delivers Mint Money Coaching for speaking with an accredited money qualified about your economic well being, expending behaviors, and extra. The initial 15-moment session is cost-free immediately after that, the support has a two-session coaching bundle (every session up to a single hour), and additional periods may perhaps be added as desired.

Intuit Mint evaluate: Simplicity of use

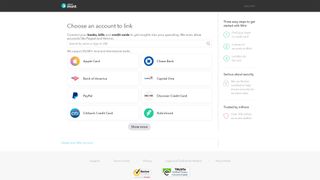

Following setting up an Intuit account (if you now have just one from making use of 1 of Intuit’s other companies, which includes TurboTax and QuickBooks — you’ll use that log-in). Mint will get straight to organization by prompting you to connect your economical accounts. Connecting accounts is a critical part of how to use the provider, but we ran into stumbles and interface oddities from the commence. The linking procedure is dependent upon the institution — some will have you enter the account data within the Mint interface, and others will call for you to authorize account entry at the fiscal establishment to start with.

The interface for connecting accounts lacks clarity and finesse (even in the beta version talked over later). For instance, to link a Citibank credit rating card, Mint 1st sends you to a pop-up to indicator into your Citibank account and decide on the accounts to join, and then it will return you to Mint to import transactions. If you have multiple accounts, all bins are checked by default, but you can uncheck boxes if you’d like to import certain accounts only.

The overview screen is the focal issue of Mint’s details presentation. And to be blunt, the initial interface we have been dropped into looked dated with its little, difficult-to-browse textual content and inconsistent visible design.

Then we observed that a beta edition of most views was accessible, and we chosen that solution. The Mint beta substantially transformed the service’s usability and visual aesthetic.

In accordance to Intuit, the redesign was rolled out quickly to a “small percentage” of consumers, then was paused to make further adjustments dependent on consumer suggestions. After these issues are fixed at an unspecified time, Intuit says “the rollout will start.” Since the redesign is so considerable, we’ll revisit this assessment when the rollout commences anew to see if everything about our experience transformed.

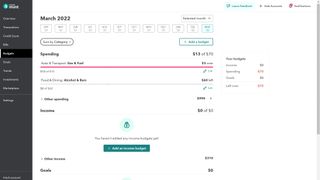

The redesigned web interface represents a substantially-needed refresh, and the up-to-date look and truly feel mimics the current interface of TurboTax. The services takes advantage of larger-sizing fonts fonts and heavier pounds for the text, two changes that together improve readability. Even the graphics are much larger and a lot easier to examine. Curiously, the selections below really don’t replicate the organization and presentation of the lately current cell application (additional on that later on) — but potentially which is portion of the beta that continues to be a do the job-in-development.

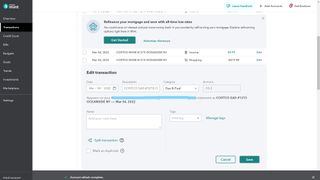

We seen a smoother knowledge when we reviewed our credit history card transactions. The information was presented clearly, and it was easier to type by classification working with a drop down filter (right before it was a hypertext url off on the aspect of the web site, in very small textual content).

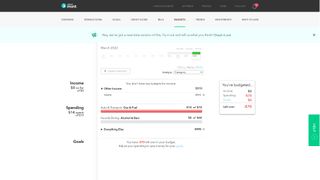

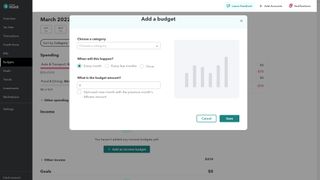

As with the prior model of Mint, the beta Mint internet site lacks any unique steering on how to spending plan. But location budgets for specific classes is straightforward, and the company operates nicely to exhibit you your money, shelling out, and targets all in just one position so you can see if you’re on track at any supplied time.

When including a funds class, you can decide on the frequency, set the budget amount of money, and decide on to begin a new thirty day period with the leftover quantity from the prior thirty day period – proficiently rolling in excess of any overages or personal savings. The groups will car-populate with matching expenditures discovered in your joined accounts. We appreciated how we could form by which classes are over or underneath budget, which is helpful for eyeballing spots to slash again on. Your ambitions appear at the bottom of the webpage.

Intuit Mint review: Cell

Intuit delivers committed iOS and Android apps. We tried using the early March update on Android that rolled out a minty green visible redesign that is large on using the info you have related to make appealing graphics. Only the mobile variations give the alternative to take out ads, for $.99 for every thirty day period or $4.99 for Mint High quality on iOS. Protection seems solid — we experienced two verifications ahead of logging in.

Every part of the support has a button together the top rated of the monitor. Beneath that is a visualization of your patterns, a context-sensitive graph that variations relying on which section you’re in. Paying out is the 1st one particular you will see on opening the application, practical if you are attempting to track how significantly you’ve expended at a individual time.

For even more detail, you will scroll down to decide on from between the buttons down below. The principal navigation — residence, every month, market, and notifications — is a dock at the bottom of the monitor, and only noticeable when you are at the top rated of a web site.

Budgets are no longer broken out on cellular as a separate label. As an alternative, you can access your price range data below the aforementioned new every month tab — alongside with your investing, costs and subscriptions, plans, and bill negotiation. The latter aims to lower your expenditures and appears to be like a element, but it is an excess-expense support powered by BillShark (you only spend if they succeed). You are on your own to simply click all-around to established a price range — the application lacks direction on how to get commenced, and arbitrarily sets the finances for you when you insert a classification (it chose $100 as the funds, but we could adjust by modifying a slider).

You can also manually incorporate a transaction as a spending budget line merchandise, and choose no matter if it is money or expenditure and the payment type. On the complete, location a spending budget through cell lacks clarity (for illustration, you are including a transaction to a month, not to each individual thirty day period — as you can obviously do by way of world wide web browser) and fewer detailed than we’d have envisioned. We did like the visuals for month-to-month cash move and investing categories, even though.

At the time of our overview, Mint Quality was only available for iOS (the Android variation will come, but Intuit did not give a focus on launch date). Mint Quality provides checking and cancellation paying out projections based on your information and trends a progress estimator for visualizing the affect of a decision today on your financial upcoming tomorrow and income spotlights that offer visualizations based mostly on your spending behavior and tendencies as in comparison with people of your fellow Minters.

Intuit Mint evaluate: Verdict

Mint is a well-rounded and totally free personalized finance support for getting a photograph of your fiscal wellness. The beta interface is gentle many years in advance of the place the support has been, but for now Mint however has room to improve clarity and direction within the provider.

Nevertheless, Mint stands by yourself in presenting a 15-moment are living consultation with a coach and the choice to grow to several sessions (Simplifi by Quicken features 15-minutes that targets individualized app navigation vs. than economic coaching). The closest any other provider arrived was YNAB, which has no cost stay Zoom education and learning classes which educate you how to use the services, and supply an opportunity to request the instructor issues.

We felt that Simplifi by Quicken does a better task helping you think as a result of your cash movement in the context of your bigger fiscal picture, and it handles budgets in a a lot more intuitive way, with far better documentation. Nonetheless, it expenses $5.99 per thirty day period, earning it $4 additional than the advertisement-no cost model of Mint. Mint’s combine of features and operation will make it stand out for equally monitoring your net worthy of and environment budgets, but we definitely hope Mint rolls out its new interface quickly.