Apple Bounce Can’t Shake Off Chilling Signal for Stock Market

(Bloomberg) — The 7 days is ending on a higher notice for Significant Tech on hopes a relentless selloff could be nearing exhaustion. But Friday’s rally just cannot completely wipe out a sobering sign from Apple Inc. shares.

Most Read through from Bloomberg

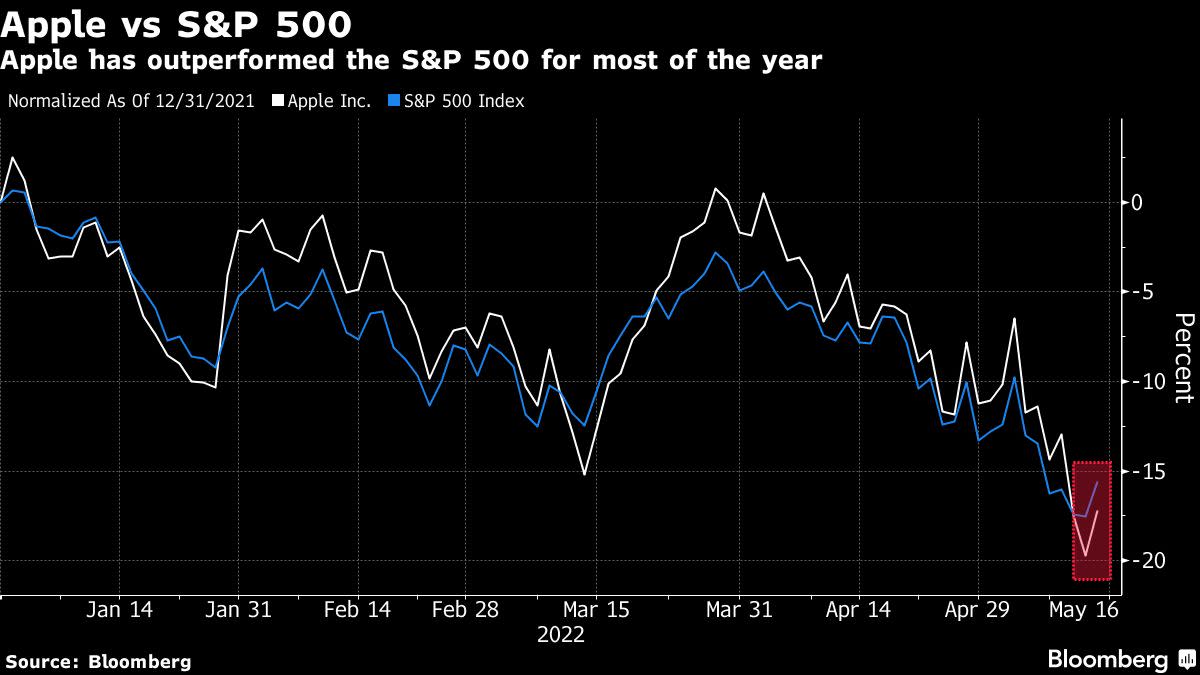

Immediately after acting as a ballast for the broader industry for most of the 12 months, the stock broke down this week, with losses as a result of Thursday exceeding 9{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}. Even just after Friday’s rebound, Apple is now underperforming the S&P 500 for the calendar year. And this, analysts say, is worrisome.

“It is a troubling indicator when investors bitter on most effective of breed names in an currently complicated tape,” stated Nicholas Colas, co-founder of DataTrek Investigation. Apple’s slide “is aspect of a more substantial trend of investor risk aversion.”

It would be hard to overstate the worth of Apple for the rest of the market. With more than $2 trillion in price, the business has the most significant weighting in the S&P 500, helping sway the benchmark in both direction. Further more losses for the inventory upcoming week could assistance mail the index down again.

“It’s mathematically not possible for the S&P 500 to increase when the largest shares maintain falling,” reported Kim Forrest, main investment officer and founder of Bokeh Money Partners. Seeing Apple drop so speedily is “chilling,” she said.

Apple rose 3.2{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} on Friday, ending the week down extra than 6{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} and erasing about $165 billion in industry benefit. The losses were being punctuated on Wednesday when Aramco, the Saudi Arabian oil giant that is benefiting from increased electricity costs, overtook the organization as the world’s most beneficial.

Apple’s huge profits have built it a popular desired destination for buyers trying to find harmless haven property amid marketplace turmoil. But it is now getting swept up in the promoting that started out with far more speculative development stocks, which are valued much more for their promise of upcoming profits, generating them more vulnerable to bigger curiosity charges and inflation.

Silver Lining

Of class, the selling could be a indicator that traders are ultimately capitulating and shares are poised for an extended rebound, stated Forrest at Bokeh Funds Associates.

1 positive signal is that retail buyers have ongoing pouring income into stocks this year in spite of the selloff and are nevertheless buying Apple. The stock was the next-most acquired by retail traders in the five days previous May perhaps 11, in accordance to data from Vanda Study.

Jason Benowitz, a senior portfolio supervisor at Roosevelt Financial commitment Group, claims he’ll be viewing information out of China to gauge the route of Apple’s shares. Covid-19 lockdowns in the region have disrupted the financial system and threaten to exacerbate source chain snarls that have price the enterprise billions of dollars in lost income in recent quarters.

“There’s problem appropriate now about the skill to work in China,” he said. “Risk is heading to be present for some time.”

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.