Chris Ryan | Getty Photographs

Investors are bracing for 2023 amid stock market place volatility, mounting interest prices and geopolitical danger — with numerous carrying economic downturn fears into the new calendar year.

But even with economic uncertainty, financial gurus point to timely opportunities, urging investors to place cash into the current market, instead than leaving it on the sidelines.

Agreeing with lots of in the advisor group, Betterment CEO Sarah Levy stated she expects a “turbulent and unstable to start with fifty percent of 2023,” but her extensive-term outlook is optimistic.

“Above a 5- and 10-calendar year horizon, this is a fantastic second for that greenback-price averaging prospect,” she stated, talking at CNBC’s Money Advisor Summit on Tuesday.

A lot more from Own Finance:

4 crucial calendar year-conclusion moves to ‘control your tax reporting destiny’

Supreme Court docket probable to rule Biden college student loan prepare is illegal

Amid inflation, dad and mom are paying out for Gen Zers’ vacation this vacation

The method powering dollar-charge averaging is putting your cash to do the job by investing at set intervals around time, no matter of what transpires in the market.

Even though study displays investing a lump sum sooner may possibly offer you higher returns, some authorities say dollar-value averaging may support prevent psychological financial commitment selections.

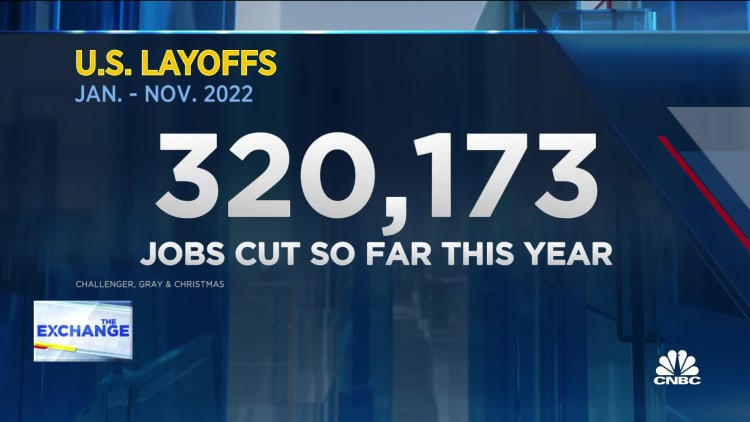

Immediately after double-digit losses in 2022 for each the stock and bond marketplaces, it is uncomplicated to see why some might be hesitant to carry on investing. But experts say the anxiety of reduction can be expensive, and you might miss the market’s ideal restoration days.

The 10 ideal times above the earlier 20 a long time transpired soon after big declines for the duration of the 2008 money disaster or the pullback in 2020, in accordance to an analysis from J.P. Morgan.

“Just take command of the issues you can control,” Levy stated, noting that automatic, recurring investments can assist “take the emotion out of the equation,” when the marketplaces dip, she claimed.

There are possibilities for hard cash as curiosity costs increase

Even so, growing curiosity prices have produced substantial-produce discounts accounts more appealing, Levy mentioned. Traders may perhaps benefit if they’re maintaining revenue at the “right institutions” the place greater produce is remaining passed along to the consumer, she claimed.

“Dollars in a financial savings account is obtainable capital,” Levy explained. “There seriously isn’t really any profit to locking revenue up with any variety of duration.”