4 Concerning Personal Finance Charts

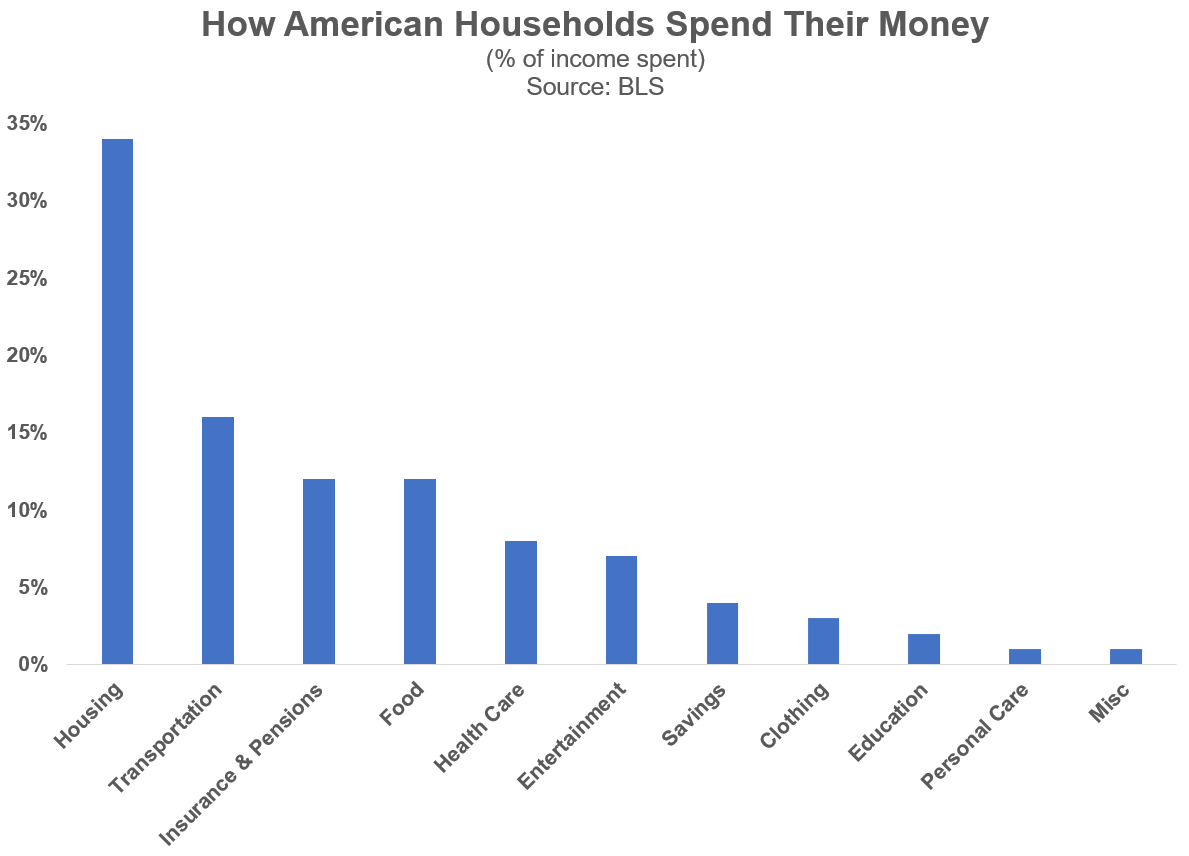

This is how Us residents shell out their funds1 (in accordance to a review by the Bureau of Labor Figures):

Like most aggregates when you are working with hundreds of millions of folks, everyone’s expending is in all probability relatively various than these averages.

But directionally these figures seem ideal to me from a big-picture standpoint. The two greatest line objects for the bulk of homes are housing and transportation.

These two categories make up fifty percent of the spending budget in the normal American family.

If you want to get in advance monetarily you have to rightsize housing and transportation. If you shell out way too much revenue on your dwelling situation or your car or both equally you’re heading to have a hard time creating wealth.

I never like to devote shame people today but I have been anxious for a range of many years now about how significantly folks are investing on trucks and SUVs.

It’s obtaining out of hand.

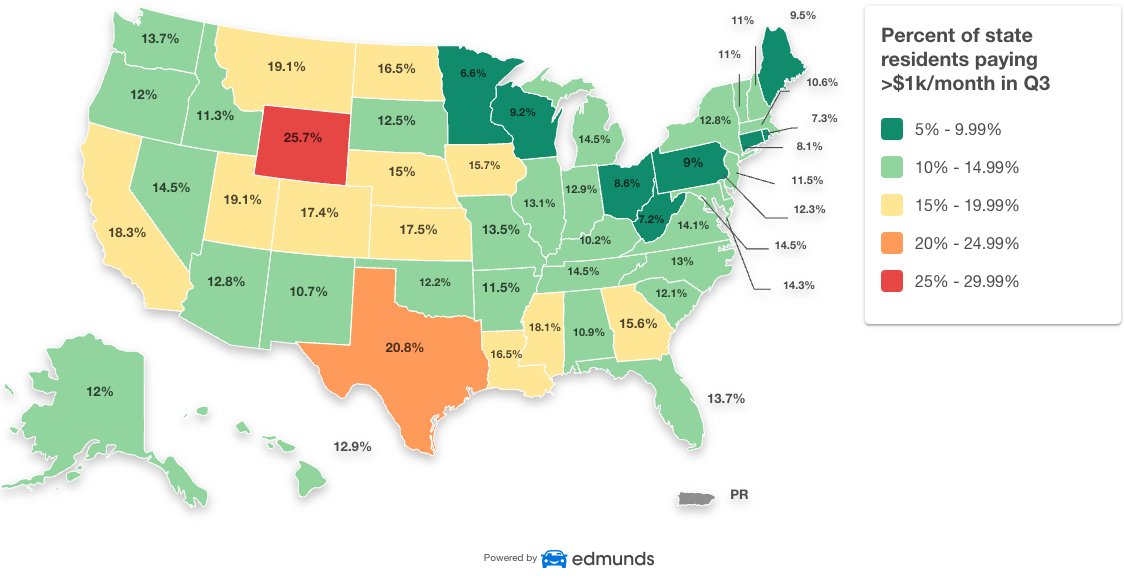

Glance at this chart that displays the percentage of residents by condition having to pay $1,000 a month or much more for their vehicle payment:

1-quarter of folks in Wyoming are paying more than $1,000/thirty day period! Much more than just one-fifth of people in Texas are doing the exact. It’s virtually 1 in 5 in California.

This is personalized finance insanity.

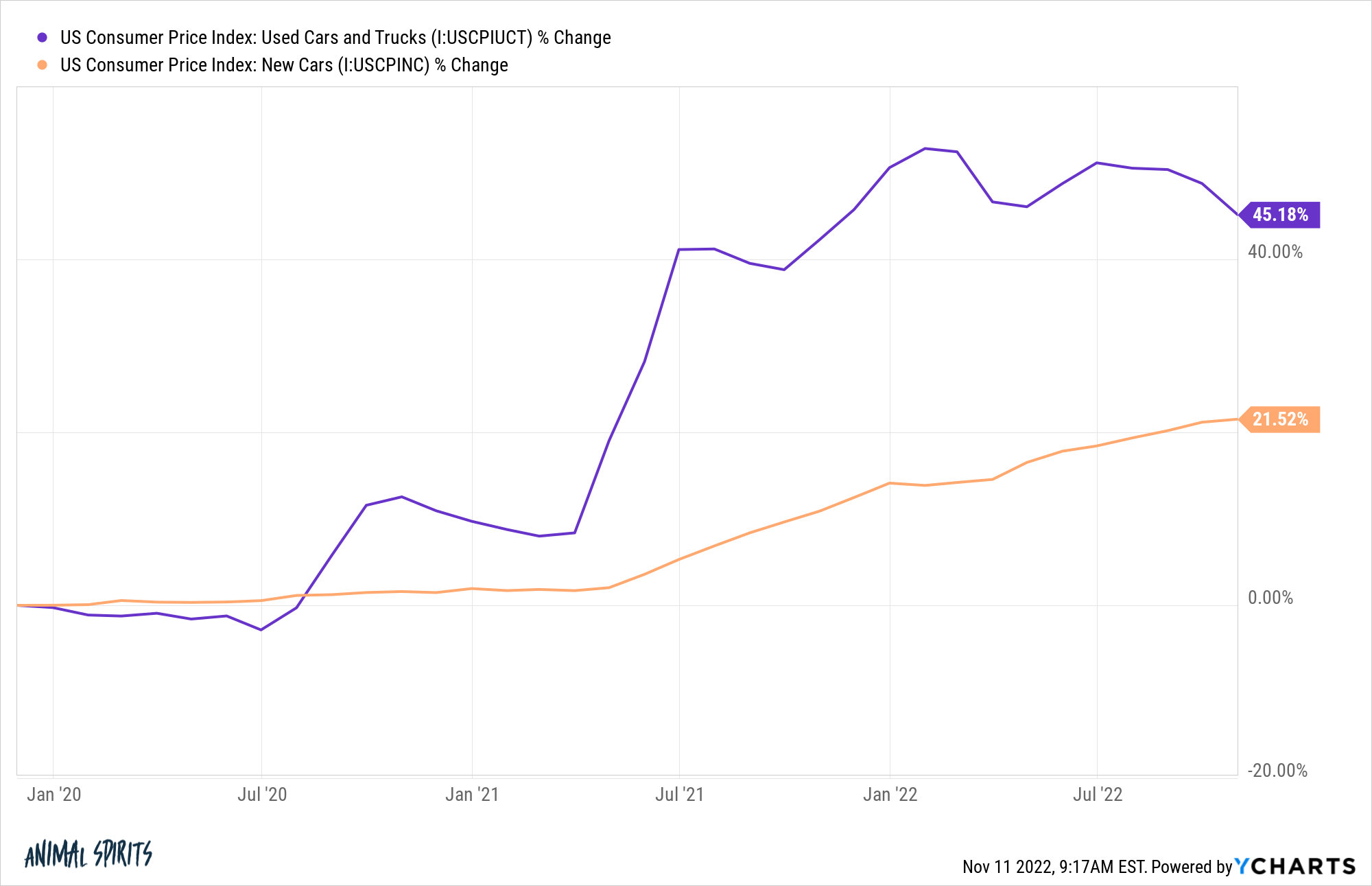

There are a variety of financial explanations these payments have been soaring in new many years. The source chain shortages have driven up the expense of cars and that’s nonetheless not back to usual.

In the previous 3 yrs on your own the rate of new vehicles is up far more than 20{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}. Applied vehicle price ranges are up a lot more than 45{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}:

Anyone who has had the misfortune of needing to buy a automobile has been in a tricky location in the latest several years.

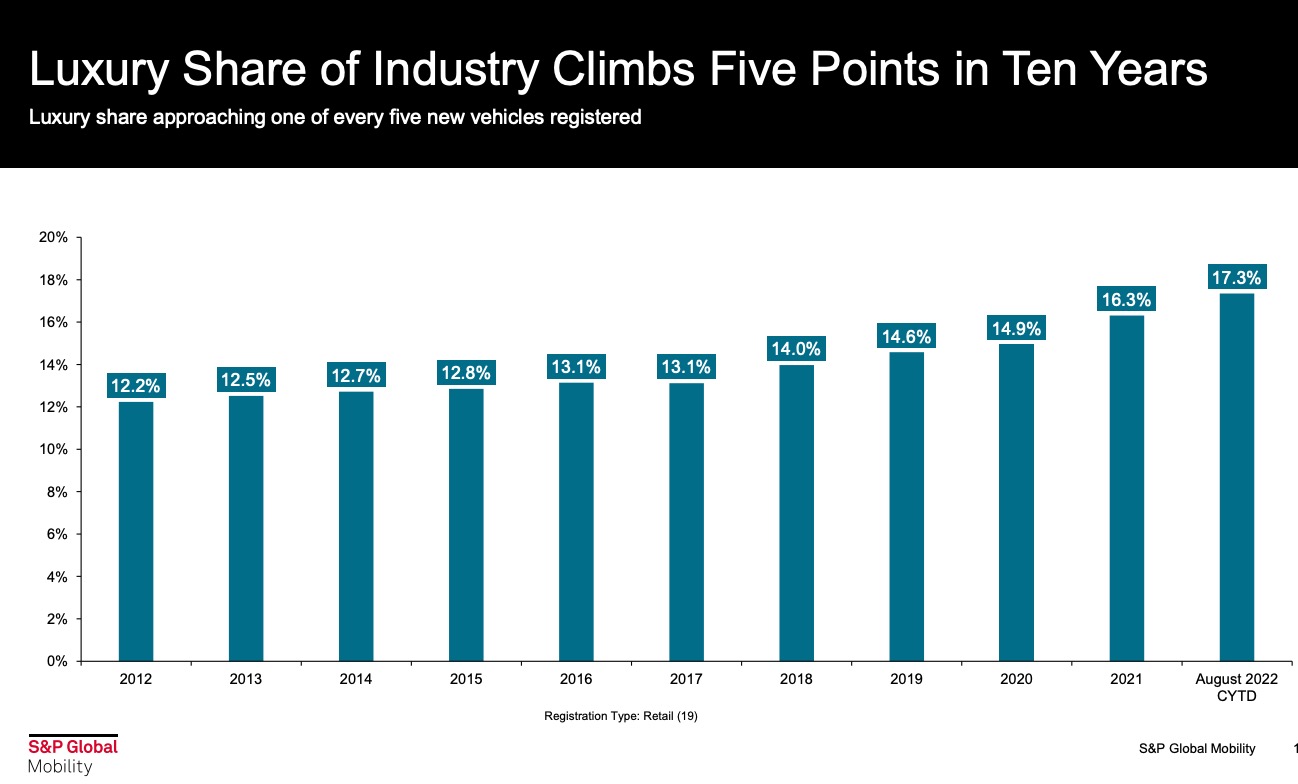

But that’s not the entire clarification. Appear at the increase in luxurious automobile purchases more than the previous 10 yrs:

It’s almost 20{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}.

I am an A to B man when it will come to my vehicle. Some people take pleasure in driving a good vehicle, truck or SUV.

And that is high-quality — assuming you have the relaxation of your funds in order and you are saving dollars.

If you’re not preserving sufficient, your ridiculously high SUV or truck monthly payment is the most likely offender holding back your wealth.

And if it is not your vehicle alternative, it could be housing which is holding you again.

The New York Moments made the situation this 7 days that the housing marketplace is even worse than you feel.

I are likely to agree.

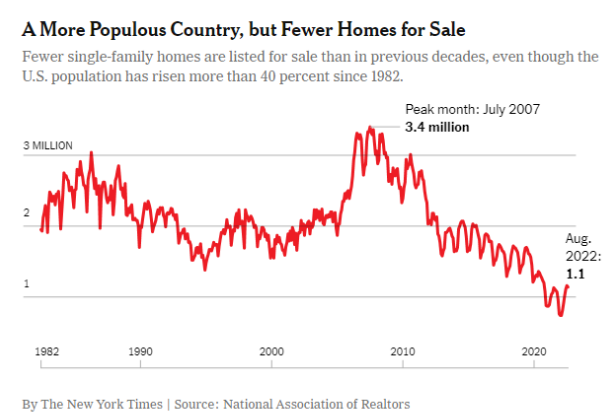

They demonstrate the selection of solitary-spouse and children properties for sale stays around its most affordable degree in 40 a long time:

But this chart is even worse than it appears. The Moments points out the U.S. inhabitants has risen far more than 40{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} considering that 1982.

There had been close to 230 million individuals in the United States in 1982. There are now additional than 330 million. The ratio for each human being is so much even worse now.

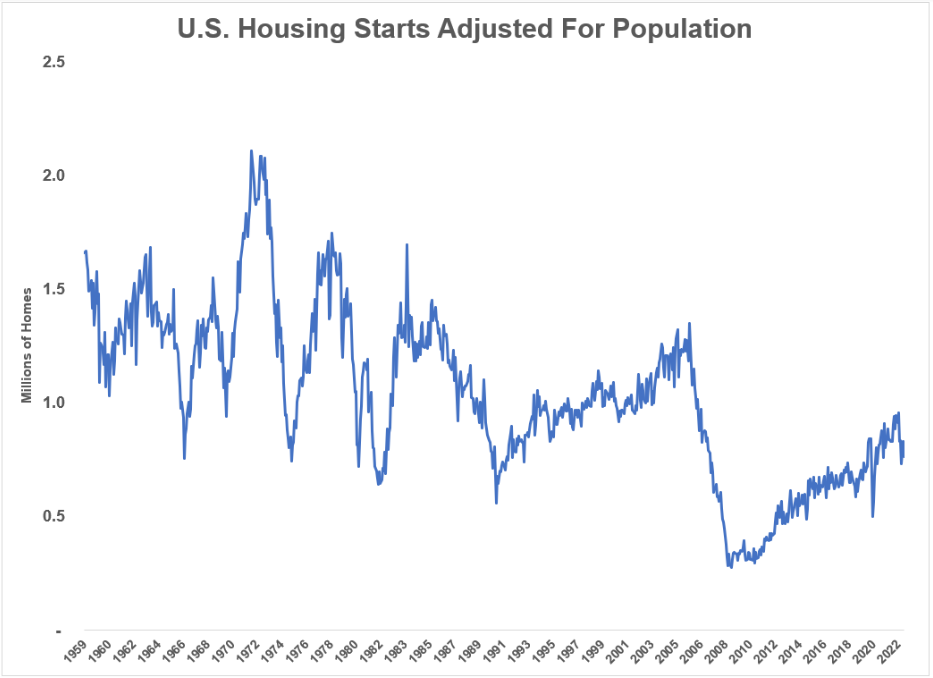

The identical is accurate when it arrives to the range of new homes becoming created. I altered U.S. housing starts (when construction starts on a new dwelling) for the population going again to 1959:

We have been making so a lot of more homes relative to the sizing of the inhabitants back again in the 60s, 70s and 80s. Matters have been quite very good in the 90s as nicely.

Then the serious estate bubble burst in the 2000s and we have not gotten anywhere shut to those degrees yet again.

In 1959 there were approximately 176 million men and women in the U.S. and we were being creating about 1.6 million homes a 12 months.

We now have 333 million men and women and the much more latest looking at reveals we developed 1.4 million houses in the past yr.

Sad to say, there is a great deal of luck involved when it will come to your housing circumstance. Sure, there are individuals who purchase a lot more household than they can pay for but a whole lot of persons get screwed or fortunate based mostly on the timing of when they ended up born and the place we are in the housing cycle.

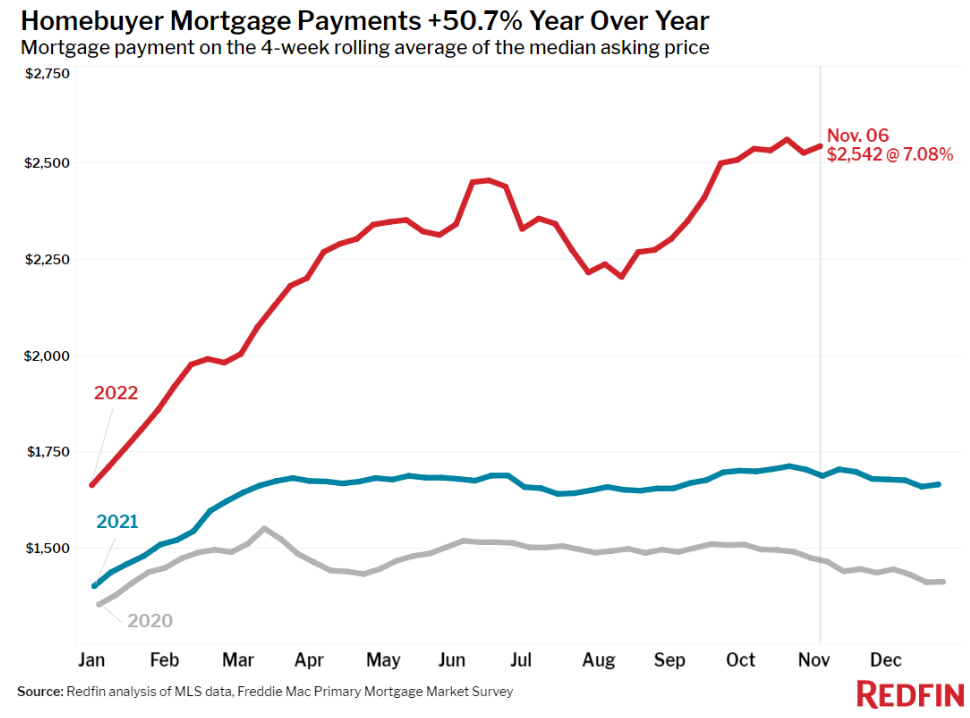

Housing costs are now rolling over from bigger mortgage loan rates but these quite similar home loan charges have built it even extra highly-priced to obtain a home proper now.

Things will stage out finally and ideally mortgage prices will drop in the many years ahead.

But if we never make much more homes in this state, shopping for a household is going to be more durable and tougher for younger individuals in the long term.

Michael and I talked about car costs, the housing market place and a great deal much more on this week’s Animal Spirits video clip:

https://www.youtube.com/view?v=equIQLJdYH0

Subscribe to The Compound so you never overlook an episode.

Even further Examining:

Is the Ford F-150 Partially Liable For the Retirement Personal savings Disaster?

Now here’s what I have been looking through currently:

1This is as a share of income so following tax.