Average life insurance rates are steady entering 2022

Every month lifetime insurance plan premiums were being secure coming into the new 12 months, in accordance to Policygenius information. (iStock)

The everyday living insurance plan sector has held price ranges secure coming into 2022, according to Policygenius. Most non-people who smoke noticed smaller amount raises of less than 1{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} between December 2021 and January 2022, whilst people who smoke failed to see any improvements in their month to month rates.

Average lifestyle insurance policies rates have stayed continuous regardless of a rise in mortality connected to the coronavirus pandemic. Demise reward payouts rose 15.4{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} in 2020, in accordance to the American Council of Lifetime Insurers (ACLI). On the other hand, Policygenius facts indicates that individuals really don’t have to worry about mounting daily life insurance policy rates at this time.

Continue to keep reading to find out a lot more about the normal existence insurance charge for every thirty day period, as nicely as how lifestyle insurance coverage rates are determined. If you’re contemplating taking out a daily life insurance plan plan, stop by Credible to get absolutely free existence coverage rates.

IS Long term Daily life Coverage A Good Strategy FOR YOU?

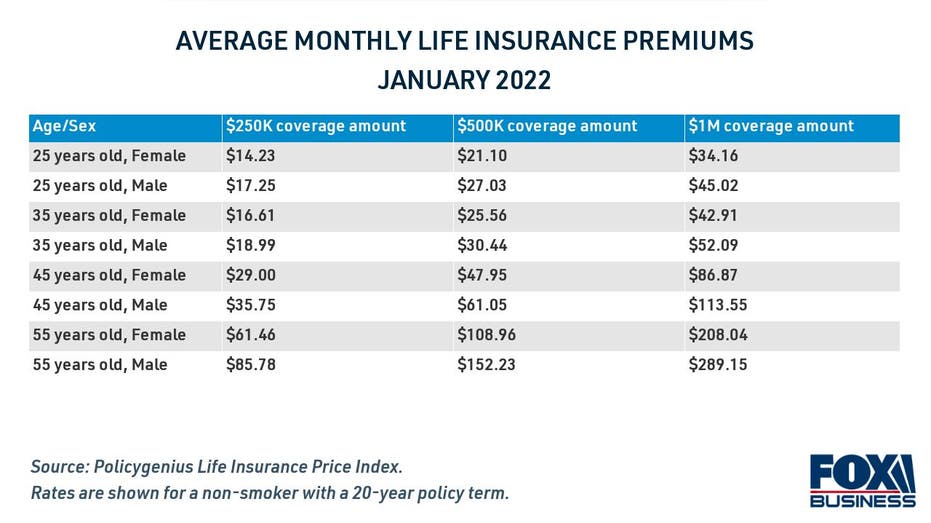

Typical price tag of everyday living insurance by age and gender

Monthly life insurance policies rates remained regular entering the new year, according to Policygenius facts, with a negligible raise from December 2021 to January 2022.

Everyday living insurance plan charges are least expensive for younger policyholders with small well being threats, while costs are inclined to rise with a policyholder’s age. For case in point, it fees $25.56 for each month to insure a balanced 35-12 months-outdated female with a 20-12 months time period existence insurance policies plan truly worth $500,000. That same policy would value $152.23 monthly for a 55-12 months-outdated gentleman in good health and fitness.

Regular lifestyle insurance coverage rates are also noticeably larger for people who smoke than they are for non-people who smoke. The plan used in the example above would expense $224.46 per thirty day period for a 45-year-outdated person who smokes, in contrast to just $61.05 for a non-smoker of the same age.

No matter a person’s age or overall health score, however, existence insurance coverage premiums have stayed somewhat stable into 2022. If you are shopping for existence insurance, you can look through guidelines and see regular prices personalized to you on Credible.

Life Insurance plan Value BREAKDOWN BY AGE, Time period Size AND Plan Size

How are everyday living coverage premiums calculated?

The monthly expense of existence insurance policy relies upon on a policyholder’s lifetime expectancy. Lifetime insurance companies take a quantity of factors into account, these as age, sexual intercourse, wellness, health care heritage and even leisure hobbies. Individuals who are riskier to insure ought to anticipate to shell out increased regular monthly rates, whilst very low-chance policyholders will price tag considerably less to insure.

To figure out your wellness danger, life insurers may involve you to undergo a health care examination. Health and fitness situations like high blood stress or being overweight can component into the general price of a lifestyle insurance policy.

Rates are also dependent on the form of lifestyle insurance plan you have. Lengthier plan terms will have higher month-to-month prices, even though shorter policy conditions with reduced coverage amounts will be less expensive.

It’s commonly encouraged to purchase lifestyle insurance plan with a protection total equal to 10-15 periods your yearly personal cash flow, in accordance to Policygenius. The plan phrase must be lengthy enough to cover you into retirement age.

For case in point, a 45-yr-previous mom who earns $65,000 yearly may want to think about a 20-calendar year time period policy with a $1 million protection amount. That is about 15 occasions her once-a-year earnings, which may be necessary to choose treatment of dependents if she dies unexpectedly.

On the other hand, a 35-calendar year-outdated married gentleman with no youngsters who earns $50,000 per yr could look at a 30-12 months lifetime insurance plan term with a protection sum of $500,000. That policy is lengthy plenty of to get him to retirement age, and the demise reward amount might be enough to protect bills for his spouse.

When it comes to selecting a life insurance plan, you can find no one particular-measurement-fits-all approach. You’ll will need to contemplate the greatest plan for your lifestyle and money predicament. Get in contact with a monetary professional at Credible to determine your life coverage demands.

Getting Everyday living Insurance policy Though You are Youthful AND Healthy CAN Preserve YOU Hundreds

Have a finance-connected dilemma, but will not know who to ask? E mail The Credible Funds Pro at [email protected] and your issue may possibly be answered by Credible in our Funds Pro column.