Do I need travel insurance for my holiday?

With folks starting up to travel overseas once more in good quantities and Covid-19 even now very a great deal present, the concern of travel insurance policy is the moment once more top rated of intellect for many.

If your vacation is cancelled or if a little something goes improper while you might be away, travel insurance plan is made to protect some – or all of the costs.

For a lot of, travel insurance is an afterthought at the time the excursion is booked.

Even so, David Hughes, Director of on the net insurance provider GetCover.ie, said in an crisis, vacation coverage often becomes important.

“Get your vacation insurance policy right, just before something goes mistaken,” he urged.

What style of travel insurance coverage is on offer you?

There are a few unique forms of insurance policies you can select from – a one vacation policy, an once-a-year plan or a extended-stay policy, from time to time referred to as a backpacker policy.

Some vendors also present specific insurance plan for business relevant excursions.

Mr Hughes claimed you need to have a very clear journey approach right before selecting your policy.

“If the man or woman intends travelling at the time for 14 times or less, a one trip coverage is great,” he said.

“If the intention is to travel extra than when all through the year, or if the journey is possible to last for a longer time than 14 times, an annual policy generally operates out less costly,” he spelled out.

Mr Hughes reported for most vacation insurance policy suppliers, an annual policy will allow the shopper to vacation as a lot of moments as they like up to a certain restrict.

What amount of protect should really I select?

Most vendors provide two or a few concentrations of cover – top rated stage, mid selection and finances.

Mr Hughes stated most bundle outings are sufficiently coated by a mid-vary coverage.

But if your trip is specifically costly, he mentioned a best end plan could be really worth the cash.

“Choose a glance at the gains and make your choice,” he proposed.

“Most claims are connected to clinical emergencies, cancellation or baggage and personalized consequences,” he explained.

In common, what does journey insurance policies go over?

Travel insurance can cover a quantity fees arising from distinctive conditions, including disease or injuries, damaged or delayed luggage, cancelled flights, delayed or missed departure and decline or theft of funds or passport.

A spokesperson for the Opposition and Buyer Security Commission (CCPC) claimed they would inspire shoppers to study the particulars diligently, ahead of obtaining a vacation insurance plan.

“We would also advocate that they check the terms and problems for any references to certain situations or conditions where by they would not be protected by their coverage, as this will have to have to be taken into thought as to whether or not the policy is proper for them,” the spokesperson stated.

Will my coverage protect me if I get Covid?

Whilst most vacation insurance policies procedures include varying concentrations of Covid-19 go over, some will not give you any include at all.

In advance of purchasing, the CCPC explained you should really question your supplier the following thoughts:

– What protect do I have if I was to test optimistic for Covid-19 throughout my journey?

– What if I was to examination positive for Covid-19 before I am owing to depart and I’m unable to journey?

– If the Covid-19 predicament in my spot was to deteriorate although I’m there, am I even now coated?

To give you an example, Mr Hughes said GetCover.ie provide the adhering to Covid linked protect.

Cancellation address

– If you or your travelling companion(s) receive a beneficial Covid analysis in the 14 times foremost up to any vacation, you can declare for your lost travel expenses.

– If you or your travelling companion(s) are hospitalised with Covid in the 28 days leading up to any vacation, you can assert for your lost travel expenses.

-You will not be coated for any losses or expenses relating to Covid that arise within just 7 days of the date you procured this insurance policy, besides the place the insurance policies is acquired with 48 hours of booking the trip.

More vacation and accommodation charges whilst overseas

-In the celebration of a beneficial analysis of Covid abroad, the plan will deal with acceptable additional transport (economic climate course) and/or lodging expenses incurred up to the standard of your first booking if you have to extend your remain, up to the quantity of €2,000.

Unexpected emergency health care fees

– The insurance policies will address you for crisis professional medical and other costs, supplied that you are not travelling to a state or precise location or party to which the travel guidance unit of the Division of Overseas Affairs (DFA) or the Entire world Wellbeing Organisation (WHO) or comparable physique has advised towards all or all but critical journey. In this circumstance the coverage will not deal with Covid.

Do I require to declare a pre-present professional medical affliction?

When obtaining your coverage, study the clinical declaration on the coverage cautiously and make sure you abide by the disorders.

Mr Hughes of GetCover.ie said journey insurance policy procedures are “off the shelf” or “just one measurement suits all” goods.

This signifies they do not go over most current or pre-present professional medical disorders – unless people conditions have been declared and any suitable further high quality has been paid.

“A buyer can call a clinical screening line once they have purchased their policy exactly where they can invest in the optional extra protect for their medical problem,” he explained.

While, the optional address is not compulsory in most instances, Mr Hughes claimed it is recommended to invest in it.

He mentioned significant blood strain is an illustration of a issue that wants to be declared, in purchase to be covered.

“It is commonly included for a modest additional top quality.

“If it’s not declared, and the shopper has a coronary heart attack while overseas they will in all probability not be included for their professional medical or repatriation costs,” he discussed.

“That can be a pretty expensive proposition,” he added.

Mr Hughes claimed some insurers, these kinds of as GetCover.ie, waive the want for you to declare your current professional medical situations.

What if I by now have personal wellbeing insurance coverage?

If you have a non-public health and fitness insurance coverage plan with VHI, LAYA or Irish Lifetime, test with them to see if your coverage incorporates unexpected emergency healthcare address whilst abroad.

If it does, most providers will give you a low cost on your travel coverage of in between 10{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} and 20{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}.

What does my European Wellness Insurance policies Card cover?

If you are travelling inside of the EU or to Iceland, Liechtenstein, Norway or Switzerland, the European Health Coverage Card (EHIC) entitles you to absolutely free, or reduced charge condition-offered health care.

Having said that, the EHIC is not an option to travel insurance.

It does not deal with any non-public healthcare charges, or fees such as a return flight to your home place or lost or stolen assets whilst overseas.

“In the event of an emergency, you really do not want to be stressing about how considerably the closest public clinic is,” Mr Hughes stated.

“You just want to get to the closest clinical help regardless of whether it is private or general public.

“Secondly, the price tag of repatriation to Eire is not integrated with your EHIC,” he explained.

Do I have to have extra coverage for an journey holiday break?

Travel insurance policy procedures frequently incorporate cover for a wide vary of activities.

But if your holiday break contains selected journey athletics or things to do, you may well need to have added go over.

Mr Hughes said ‘category 1’ pursuits, these kinds of as banana boating, camel riding and snorkeling are protected on all GetCover.ie insurance policies.

Group 2, 3 and 4 actions can be additional at an additional premium, and include issues like kite surfing and quad biking.

“This is quite representative of the marketplace,” Mr Hughes said.

“Winter sports activities cover generally expenditures much more and is generally included as an option to insurance policies,” he stated

When really should I take out my insurance policy deal with?

It’s crucial to choose out vacation insurance policies as shortly as you e book your vacation – rather than ready until eventually your vacation date.

This is in situation something was to go mistaken just before you go.

Also, if you purchase travel insurance following you depart, your policy is not likely to cover you for any reduction or damages that transpired right before the plan was bought.

How considerably does journey insurance coverage charge?

The rate of the plan will count on a amount of things – which includes your age, exactly where you are travelling, and how extended the coverage will past.

For instance, VHI are featuring an annual around the globe multi-trip coverage for one adult below the age of 65 for €54.

For those people aged amongst 65 and 79, it is offering a worldwide multi-trip plan for €165, or a Europe only multi-trip coverage for €99.

A VHI globally multi-trip policy for two grownups under 65 and two kids would price €114 annually.

If you get a glimpse at the Laya Healthcare site, they will check with you to deliver your date of delivery prior to giving a quote.

To give you an illustration, an annual around the globe multi-vacation coverage for somebody aged 30 will price tag you just more than €84 euro.

For two adults aged 30 and two youngsters, an yearly multi-trip coverage will price tag you just about €112.

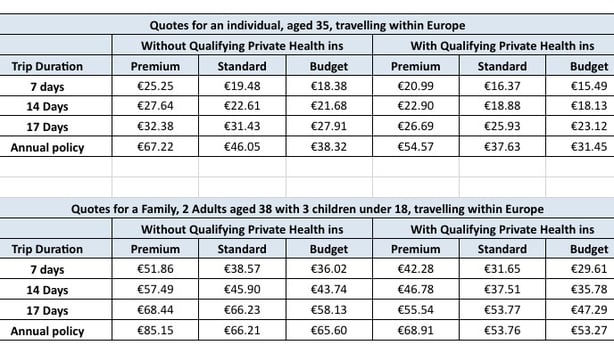

GetCover.ie offer you a few unique amounts of protect – high quality, conventional and funds.

They supplied the subsequent price examples for vacation inside Europe.

A spokesperson for the CCPC mentioned they would advise consumers not to be led by value alone, as the least expensive premium may possibly not usually be the finest value for funds.

“Individuals ought to request quotes from a number of distinctive overall health coverage companies and look at the positive aspects on offer to see what suits them best,” the spokesperson advised.