Georgia is now the latest state to mandate personal finance education

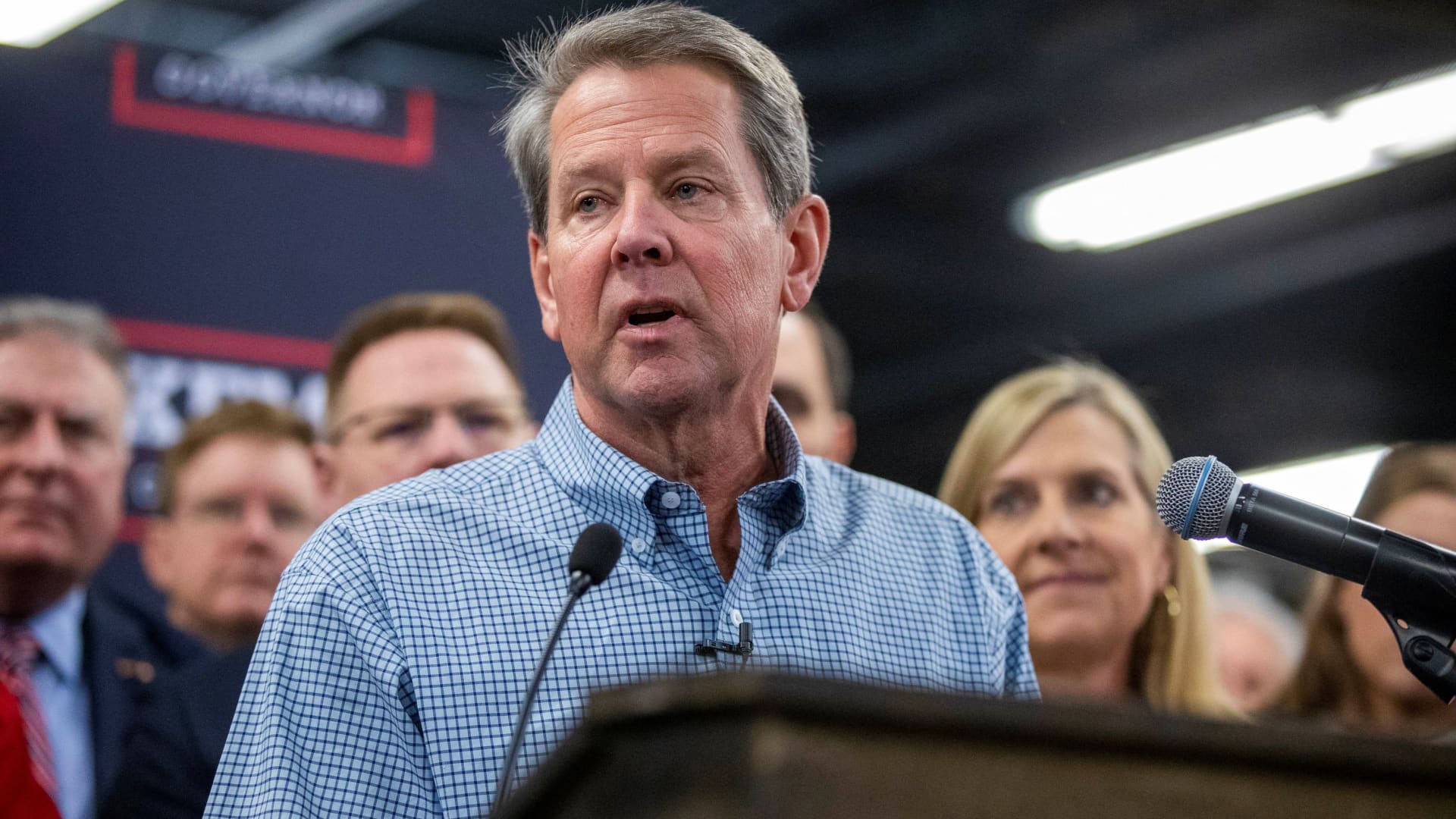

Ga Governor Brian Kemp can make remarks for the duration of a visit to Experience Outside gun store as he pushes for a new point out legislation to loosen specifications to carry a handgun in community, in Smyrna, Ga, January 5, 2022.

Alyssa Pointer | Reuters

Higher faculty college students in Ga will shortly have confirmed entry to a personalized finance course prior to they graduate.

On Thursday, Republican Gov. Brian Kemp signed into regulation SB 220, a invoice demanding individual finance courses for superior faculty pupils. Starting off in the 2024-2025 college year, all 11th- and 12th-quality learners will will need to consider at least a 50 {1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}-credit program in monetary literacy right before graduation.

The evaluate “will make certain that [students] find out economical literacy in our educational facilities, like the relevance of excellent credit and how to finances thoroughly so that they can be greater geared up for the globe further than the classroom,” claimed Kemp during the signing celebration.

Much more from Commit in You:

16 U.S. cities the place women of all ages less than 30 generate more than their male peers

Wonderful Resignation is spurring businesses to offer you financial-wellness added benefits

A 4-working day workweek pilot software is now underway in the U.S. and Canada

A rising trend

Ga is the 13th condition to mandate own finance education for its college students, according to nonprofit Future Gen Personal Finance, which tracks these types of expenses.

It is really the most current in a developing development of states incorporating individual finance schooling. In the final 12 months, Florida, Nebraska, Ohio and Rhode Island have passed similar regulations and are in the procedure of employing them for all learners.

When Georgia’s monthly bill is implemented, it will necessarily mean that far more than 35{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of college students in the U.S. will have entry to a economic literacy class. That is more than double the share of students that had accessibility to this sort of coursework in 2018, according to Future Gen Personal Finance.

Acquiring laws requiring particular finance training are critical to make certain learners have equal opportunities. There are significant educational institutions that present individual finance classes in states without the need of mandates, but entry is not equivalent, in accordance to a current report from the nonprofit.

Only 10{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of pupils in states without having assured accessibility to particular finance can take this kind of a study course. That share drops to 1 in 20 in educational facilities exactly where 75{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of pupils are nonwhite or get cost-free and minimized lunch.

What state may perhaps be next

There are still a several states with pending laws that could be passed later in the calendar year.

South Carolina, for case in point, has a bill now in conference committee. Now that Georgia’s legislation has become regulation, South Carolina is the only state in the Southeast that does not have mandated private finance coursework, in accordance to Tim Ranzetta, co-founder of Up coming Gen Particular Finance.