Government finance statistics: long-term debt securities – Products Eurostat News

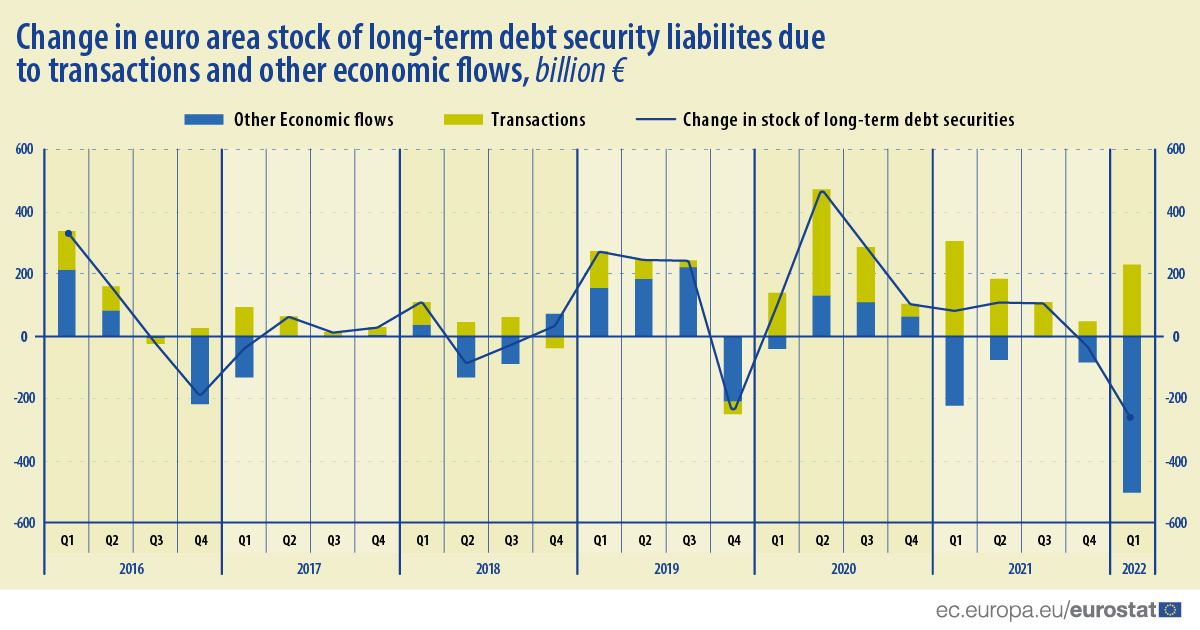

The standard federal government financial accounts deal with transactions in economical assets and liabilities as nicely as the inventory of financial assets and liabilities. In the very first quarter of 2022, the marketplace benefit of the outstanding lengthy-term personal debt securities in the euro region lessened by about €501 billion thanks to a lower in worth in the economical marketplaces. This is mostly the end result of increased curiosity fees observed. This would make the personal debt securities issued in the past, when curiosity fees had been reduce, less desirable to investors, resulting in a decrease in value. At the end of the first quarter of 2022, prolonged-expression debt securities built up about 71{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of the overall liabilities of euro region governments.

This info comes from info on quarterly govt finance revealed by Eurostat nowadays. The post presents a handful of results from the more specific Data Explained posting.

Supply dataset: gov_10q_ggfa

The remarkable amount of money of liabilities modifications either owing to transactions (primarily due to net issuance, but also owing to accrued curiosity) or owing to other economic flows (primarily value alterations also regarded as keeping gains or losses). As long-expression personal debt securities are traded on the fiscal markets, the worth of these devices modifications regularly around time. At the end of the initially quarter of 2022, the benefit of personal debt securities issued by governments in the euro area declined (by €501 billion) quicker than the internet issuance of new long-expression debt securities (around €231 billion). This resulted in a €270 billion lower inventory exceptional at the conclusion of the quarter as as opposed to the starting of the quarter and a holding reduction for collectors.

For additional facts:

Methodological notes:

- In the European Program of Accounts (ESA 2010), most assets and liabilities are valued at market place benefit. This implies that the stock of money assets and liabilities fluctuates thanks to transactions, but also thanks to “other flows”, notably revaluations (nominal holdings gains and losses).

- Prolonged-phrase financial debt securities are part of the standard government gross credit card debt as lined in the Maastricht financial debt definition stipulated in the Excessive Deficit Process. Consequently, stock data on lengthy-time period personal debt securities are also revealed at encounter benefit, which does not just take into account most price tag adjustments. The inventory at experience price can differ noticeably from the inventory at market value.

To speak to us, you should visit our Consumer Assistance website page.

For press queries, be sure to speak to our Media Assist.