How the pandemic changed personal finance and how you can save, invest and spend better

How need to just one develop their difficult-acquired cash?

This dilemma has been prepared, spoken, and debated at size and in depth. And, proceeds to.

However, most people today however find it tough to control, preserve and invest their earnings. If just about anything, the pandemic has as soon as again place the spotlight on why a person ought to plan their monetary foreseeable future early on. And, the encounter was no unique for Monika Halan, ideal-marketing writer and consulting editor and section of the management group at Indian every day Mint. She claims, like lots of, the pandemic compelled her to relook at her portfolio allocation. This is in spite of the truth that they are in their 50s and self-confident of earning even publish retirement. She reveals that it is not the current market crack of 30 {1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} that activated the rethink but the actuality that there are a lot less many years forward than a more youthful individual – each in phrases of well being and revenue.

Dollars administration: Classes from the pandemic

Monika could up her saving concentrate on sharply the working day she decides to go on a lockdown manner pandemic. Whilst she formerly regarded herself a frugal spender, the lockdown had prevented her from investing everything outside of the basic principles. Other than EMIs, hire, helper salaries and principles, the fees had crashed. This encounter of residing on so minimal was a impressive encounter, she shares.

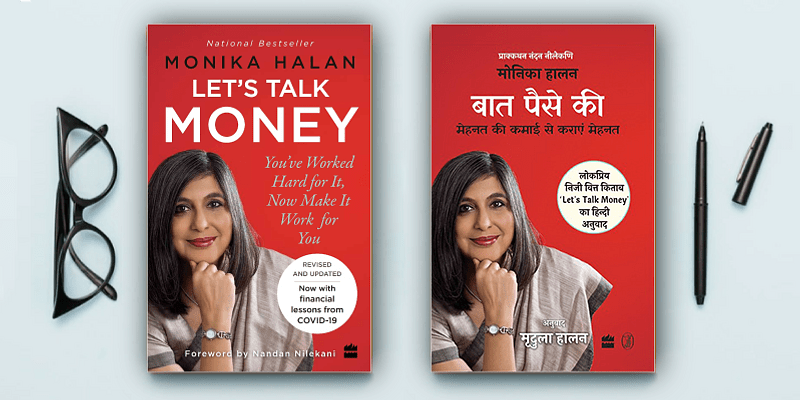

In the updated edition of her best-providing e book Let’s Speak Cash – to start with posted in 2018 by HarperCollins – Monika shares intriguing insights on what the pandemic taught all of us about our money. Pointing to a different economical lesson was the will need to have an crisis fund. Holding a higher-hazard personal sector deal occupation, she experienced managed a 6-month unexpected emergency fund irrespective of figuring out that their employment are fairly safe. But, she resolved to ramp up the fund to two years’ costs in a fastened deposit (FD). In the e-book she claims, “The want for zero-chance cash desired for survival in a safe and sound lender (PSU or 1 of the premier non-public sector banking companies) all of a sudden results in being manifest. My advice of crisis money has now transformed. For these forty years and under in a protected position, you are fantastic with six months of dwelling expenses in an FD. But as age raises, as the riskiness of the task goes up, ramp up the fund to reach two many years for older cohorts in jobs that are not that safe.”

The 3rd lesson was that of rethinking chance. From freezing of deposits by a personal lender to fund properties shutting down to market place crashing, practically nothing felt safe and sound, which highlighted that no economical merchandise was without possibility, just different forms of threats. She writes, “The fact is that there is no safe haven for your cash. Each and every investment decision arrives with some challenges and you have to make a decision which a single you are capable to just take.” And, listed here she can make an fascinating observation. She details out that danger capability and risk urge for food are absolutely two unique items. Though danger appetite refers to one’s willingness to get challenges, risk potential is dependent on aspects this sort of as age, quantity of dependents and stage of dependents, self-confidence in making earnings for a extended time. Which is why threat hunger and chance potential have to have to be aligned though setting up the funds and allocating assets. In the reserve she also clarifies why just one fastened obligation-to-profits ratio should be 30 per cent or much less. In other text, all EMIs put alongside one another ought to not be much more than 30 {1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} or fewer.

She writes, “Uncertainty obtained a new identify with COVID-19 for our wellbeing, daily life, earnings, and prosperity. Whilst the standard ideas keep on being the identical, there are some classes learnt from this crisis for our wellness and prosperity.”

Finance is for anyone

Apart from how the pandemic introduced in a shift in viewpoint on certain factors of money administration and investments – which Monika points out in detail and quotes her own investments as illustrations – the e-book holds elevated relevance for persons who are on the lookout for simple guidelines and straightforward-to-fully grasp explanations on how to deal with their cash. And, right here, Monika’s previous working experience as a certified economic planner and a leader who labored in India’s major media organizations creating and operating productive columns and Television set exhibits close to particular finance advice, will come to the fore. For her, tips are not only insightful and complete but also functional. The a lot of authentic-existence anecdotes perform an equal purpose in making it quick to realize. The guide cuts by the cutters due to the fact the explanations address each problem you experienced in mind and evidently outlines the measures you could take to regulate your funds improved amidst the Indian realities.

For instance, the e book reiterated the require to notice your investing patterns and how you can evaluate the sample to conserve income that you can later on commit. She describes how as soon as you problem your paying, you will comprehend how significantly income you really want for handling regular charges. and by parking income for investing you will be able to gauge your discounts capability. She advises that a single need to be equipped to shift at the very least 10 {1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of your in-hand salary for investments, irrespective of what your economic commitments are – be it EMIs, hire, etcetera. She writes, “Eating out, heading to the motion pictures, travelling and getting devices are the huge finances breakers. Go for a balanced instead than a hard-shelling out eating plan. Tough meal plans fall short.”

The ebook also demystifies lots of facets about dollars management and investments. For occasion, it not only describes what a healthcare insurance policy deal with is, but also if one particular need to invest

in health care include even if they are protected by their companies and how much protect a single would. It explains the distinctive policies that are available in the sector, the prices, the positive aspects and the questions one should talk to in advance of producing a selection. A different economical merchandise that the e book points out fantastically is lifestyle insurance coverage and her choose on it. She writes, “We invest in daily life insurance policy for all the incorrect motives – dread, greed, pity, irritation, taxes. The genuine purpose for a existence deal with, to shield your loved ones if you die, is hardly ever discussed.” She adds, “The working day you recognize that it is in your greatest interest to independent investments and coverage products and solutions, is the working day you go solidly to creating your fiscal stability. Else you are constructing prosperity for vendor and the insurance policy companies.”

Really do not miss out on the chapters on ‘Let’s de-jargon investing’ – character of distinctive forms of investments and the reason they serve. and what kills a cash box that talks about the a single solitary element that is liable for the investment selections.

TITLE: Let us Communicate Dollars

Writer: Monika Halan

PUBLISHER: HarperCollins India

Invest in NOW (English): https://harpercollins.co.in/product or service/allows-chat-cash/

Acquire NOW (Hindi): https://harpercollins.co.in/item/baat-paise-ki/