How to save on car insurance amid rising premiums, according to Allstate

Vehicle insurance plan charges have risen substantially in current months, even outpacing record-higher inflation, according to the latest facts. In this article are a few methods to most likely help save on your auto insurance policy. (iStock)

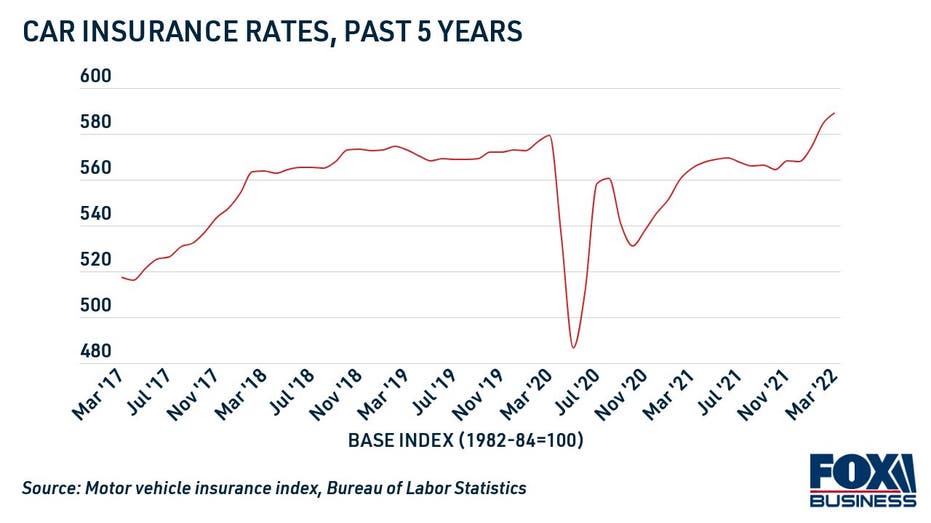

Mounting inflation has individuals spending far more at grocery suppliers and gas pumps, but some growing expenses are felt in subtler means. Details exhibits that car insurance coverage premiums are at this time outpacing inflation, which signifies motorists might expertise sticker shock when it can be time to renew their coverage — probable at a significantly bigger fee.

Regular automobile insurance policies premiums have risen 3.75{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} in 2022 by itself, in accordance to the Customer Value Index (CPI). Even with this sharp boost, the Insurance coverage Information and facts Institute (Triple-I) mentioned that rates are not “skyrocketing.” As a substitute, they are returning to pre-pandemic amounts as policyholders resume their typical driving routines.

During the COVID-19 lockdown, some U.S. staff started performing remotely and were driving less miles. This led to unexpected amount drops in spring 2020 as insurance plan corporations responded to an unexpected adjust in American driving habits.

But motorists are now hitting the street extra often as constraints are lifted, which has brought about accident frequency and severity to rise, Triple-I noted. Additionally, substitution parts are becoming a lot more high priced because of to inflation and source chain troubles. As a consequence, car insurers have had to raise rates to offset loss ratios and stay profitable.

To aid customers offset growing expenditures, Allstate has shared means to help save income on vehicle insurance policies. Keep reading through to understand much more about how to lock in less costly auto insurance policies, and pay a visit to Credible to look at free rate estimates without the need of impacting your credit rating rating.

82{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} OF Motor vehicle Purchasers Paid Previously mentioned STICKER Value FOR NEW Autos IN JANUARY

Allstate: Suggestions for conserving revenue on car coverage

Automobile insurance providers set rates primarily based on the coverage sort, deductible amount of money and your hazard rating, which incorporates:

- The zip code and state in which you reside

- Your age, gender, marital standing and credit history score

- The make and design of your motor vehicle

- Your vehicle’s use and ordinary miles driven

- Your driving record, which include mishaps and rushing tickets

- Any earlier insurance promises you’ve got submitted

Supplied these eligibility requirements, there are various approaches to minimize your vehicle coverage costs, according to Allstate. Read through about each individual money-conserving tactic in the sections below.

1. Bundle your vehicle and residence insurance plan

If you have more than 1 kind of insurance coverage policy, this sort of as homeowners insurance coverage or renters insurance policy, you may possibly qualify for a multi-policy discount by way of a solitary carrier. Credible estimates that motorists can preserve up to 30{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} by bundling their home and car procedures.

RETIREES STRAINED BY Increased House Insurance coverage Rates IN FLORIDA

2. Seek out insurers that provide minimal mileage discount rates

Leisure drivers and remote employees may perhaps be qualified for usage-based mostly insurance policy (UBI), which will allow you to pay back based mostly on the typical selection of miles you drive. To decide your mileage, insurance policy organizations may perhaps have to have you to put in a plug-in machine that tracks your driving habits.

Similarly, some car insurance plan firms offer you discounted insurance coverage that rewards safe and sound driving behaviors. It employs comparable technologies that can be applied by a cell application or tracking product that displays speeding, rapid acceleration and difficult braking.

Motorists IN THIS Point out WILL Get A $400 Automobile Insurance policy REFUND Check

3. Evaluation your plan for further auto insurance savings

Insurance plan carriers typically present a range of discounts for paying your high quality in complete upfront, enrolling in automated payments or completing a risk-free driving system. Some firms also offer you discounts for installing an anti-theft machine, this sort of as GPS monitoring techniques.

In addition to these actions, drivers may be equipped to save hundreds by shopping all around. Get at minimum three amount prices from diverse car insurers primarily based on different kinds of protection to obtain the most affordable premiums possible for your fiscal problem. You can visit Credible to check out vehicle insurance plan prices for free.

Dwelling Insurance Charges ARE OUTPACING INFLATION — AND They are NOT Probable TO Sluggish DOWN

Have a finance-relevant question, but will not know who to question? E-mail The Credible Cash Professional at [email protected] and your question might be answered by Credible in our Dollars Qualified column.