In the finance sector, what ESG jobs this way come?

A whole lot of ink (such as my possess) has been spilled to go over the ESG career market, and there is no dilemma it’s very hot.

A single of the most major drivers of ESG career progress is the abundance of emerging requirements and measurement frameworks for reporting, disclosure, performance — you identify it. Explained by TSC.ai in its new ESG Playbook as an “progressively related and facts hungry” ESG ecosystem, the authors counted additional than 2,000 reporting frameworks, prerequisites, methodologies and protocols that involve around 1,424 likely ESG efficiency indicators. See their visible beneath:

My have research and conversations have unveiled a handful of further variables driving the need for expertise in this room: a transfer from voluntary to obligatory reporting an boost in the amount of money of details that companies ought to disclose and a have to have for info that’s (substantially like a corporation’s monetary statements) strong, auditable, assured and standardized.

As a recruiter, I’ve noticed a solid uptick in requests from selecting professionals in the fiscal expert services sector — which include asset administration, coverage, personal equity and many others — who need that new hires have the practical experience and expertise to compile, decipher, assess and disclose data to fulfill necessities from a array of distinct (acronym-significant) stakeholders. That incorporates the Sustainability Accounting Benchmarks Board (SASB), the Undertaking Pressure on Climate-linked Economic Disclosures (TCFD), the Task Power on Nature-similar Money Disclosures (TNFD), the Glasgow Monetary Alliance for Internet Zero (GFANZ) and The Corporate Sustainability Reporting Directive (CSRD).

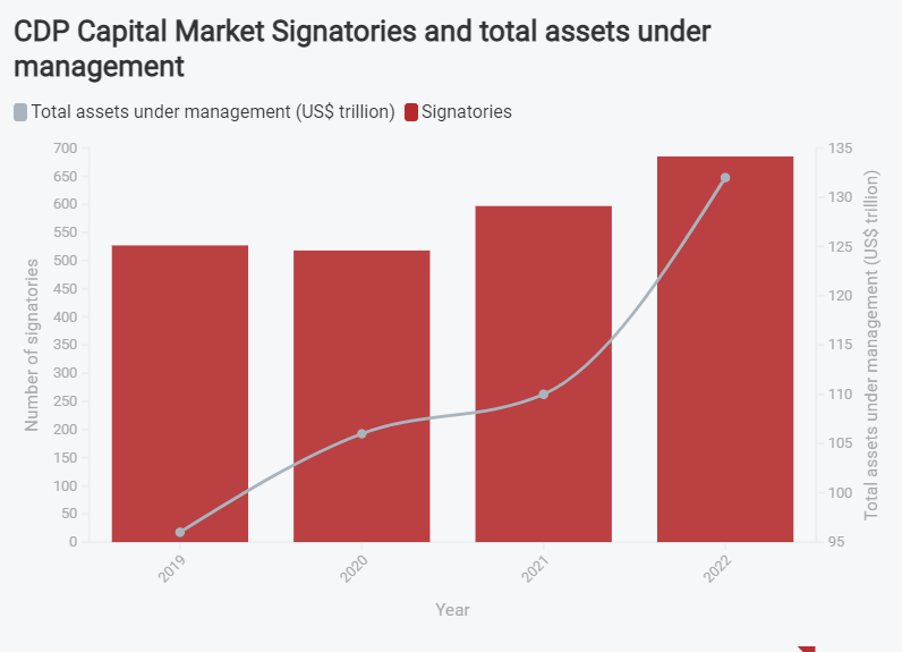

CDP carried out an analysis on my behalf revealing a striking improve in the quantity of funds market place signatories to the CDP, up from roughly 530 in 2019 to 680 in 2022.

In parallel, the range of economical institutions supporting TCFD has much more than tripled, from 287 in 2018 to 1,069 in 2021.

So what does this all suggest for persons in search of ESG positions and people hiring for them in the finance sector? For standpoint, I asked many leaders representing diverse angles of ESG the next query:

Presented all the modifications in the ESG reporting landscape, what capabilities and/or work titles will exist in your room in 2025 that you never have now?

Here’s what they explained to me, structured by ESG standpoint each individual unique represents:

Sustainable Finance

New roles in ESG and climate alignment will emerge as organizations extend their access: “In the coming decades, there will be rising needs to have appropriate governance frameworks in spot, relevant know-how in knowledge management and operational integration, and a coordinated ESG-centric leadership crew. We’ll see new positions arise, these as ‘Head of Scope 3 ESG’ for when providers lengthen their access in provide chains or ‘Head of Local climate Alignment’ to guide efforts for long run net-zero commitments. Some positions will evolve as ESG becomes embedded across business features this kind of as accounting, compliance, lawful and trader relations. What will continue being are ‘translators and conductors’ — gurus who can bridge these diverse verticals and do the job alongside one another to generate change as reporting needs rise.”

— Lissette Jorgensen, COO, Goldman Sachs Sustainable Finance Team

Choice Asset Management

Cultivation of “adaptive teams” created to find out and evolve: “I have always built adaptive groups with expertise and knowledge that evolve with the profession. At Apollo, we have built a potent talent bench encompassing reporting, engagement, communications, strategy, weather, effects, human money, ESG information/tech, citizenship, diversity, fairness and inclusion, investigate and authorized. It’s challenging to predict specific titles that will be essential, but I will continue to consider source wants primarily based on the escalating and new regulatory reporting surroundings in Europe, the U.S. and globally.”

— Dave Stangis, Associate and Chief Sustainability Officer, Apollo World Management

ESG Advisory

Motion of ESG work opportunities to functions and price creation roles: “Just one of the shifts I expect to see is a modify to wherever ESG expertise sits on the org chart. Historically, we have observed ESG sit close to [investor relations], focusing on reporting to [limited partners] and amassing portfolio-large facts for the ESG Facts Convergence Initiative and other frameworks. I be expecting the subsequent wave of ESG work to sit nearer to the portfolio operations workforce and concentration on benefit creation and operational improvements to company ESG overall performance.”

— Ryan Werffeli, COO, Malk Associates

Impression Investing

A drive to improve belief across all sectors: “Long run leaders in 2025 will will need to make alternatives that can be architected and applied throughout all sectors — business, nonprofits, and governments. As a result, the techniques of quantitative impression investing analysts, high effects portfolio supervisors and chief affect officers ought to contain (1) analytically arduous multi-sector alternative structure, (2) consequence mapping and effects accounting to the 17 global [United Nations Sustainable Development Goals], (3) collaborative entrepreneurship and teamwork, and (4) being a member of the ‘nice folks network.'”

— R. Paul Herman, CEO and Founder, HIP Trader

Reporting and Information

Depth and breadth in disclosure requirements: “Sustainability disclosure has progressively required a lot more skills because of to more complex disclosure demands. Asset administrators require to insert resources to support ESG reporting. Large corporations have dedicated groups focused on reporting. Reporters will need to have a deep being familiar with of recent disclosure standards as well as what is coming down the line. Reporting leaders’ capabilities include things like a keen analytical intellect coupled with the perception and solve to established system.”

— Elaine Cohen, Taking care of Director, Beyond Enterprise Ltd.

Personal Equity

Upskilling of offer groups: “By 2025, we are likely to see considerable alterations in ESG capabilities and task titles inside personal equity. Even though today we’re witnessing an uptick in the range of main ESG officer roles, a number of years from now, as ESG turns into a fundamental element of the investment approach, there will be much less of a require for an ESG subject matter make any difference advisor at the middle of the PE agency. Instead, main firms will have immediate associate or portfolio manager oversight on ESG ideas and how to apply them. In addition, we be expecting that ESG competencies and abilities will come to be main to every job in the business from analyst to handling associate.”

– Amy Silverstein, Husband or wife and ESG Leader, e2p

Coverage

Desire for know-how at the intersection of sustainability and business enterprise: “As insurance policy firms carry on to combine sustainability and local climate training throughout their organization styles, ever more we will see roles that demand from customers each sustainability and business acumen. Weather researchers who can translate evolving local weather info into possibility for inner and shopper education and learning, as nicely as specialists who realize biodiversity-similar dangers, will also be remarkably sought right after.”

— Rakhi Kumar, SVP, Sustainability Methods and Business enterprise Integration, Liberty Mutual Insurance

Facts

Professionals and professionals who can put together for mandated disclosures: “Given the world-wide regulatory developments, a lot more organizations will be essential to disclose ESG facts. Quantifiable info, this sort of as carbon emissions, is already growing in breadth and depth. Verification or assurance of these knowledge is also increasingly expected. Specializations are already rising in local climate science and info collection, and administration, as perfectly as carbon and all-natural, social and human capital accounting. This will only boost as much more economical establishments scrutinize the organizations in their portfolios.”

— Mike Wallace, Senior Vice President, Strategic Industry Engagement, Persefoni

3 predictions for ESG employment in the financial providers sector

So what does this all mean when it arrives to ESG expertise traits in the finance sector? I predict a few traits:

- Ongoing development: Regardless of financial slowdown on lots of fronts, the volume of positions will continue to develop in line with the hockey stick of advancement of standards used to consider ESG progress.

- ESG roles will expand closer to the CFO: As ESG disclosures turn out to be a lot more standardized, they are also turning into more built-in to monetary reporting and hazard disclosures that are living in the workplace of CFO. I predict much more CSOs reporting to the CFO as their perform going ahead will call for much more alignment.

- “E” experts will have the steepest advancement curves: The urgency of local weather improve is plain, and for lots of firms web zero by 2050 (or even 2030) is on the horizon. The operate wanted to start out yesterday. In addition, youthful generations who are primarily attuned to international warming will search for perform with organizations that just take the subject significantly, which will maximize the need for these jobs.

On Sept. 14, I’m top a dialogue at Private Equity International’s Responsible Expenditure Forum in San Francisco especially on how to Gain the War on Expertise. We’ll dive more deeply into these tendencies, and chat about what using the services of managers can do to catch the attention of and keep ESG pros. Sign up for us or attain out to share your viewpoint on the explosion of ESG employment in the economic sector.