Insurers tout benefits of diverse workforces

The excess and surplus lines insurance market has an opportunity to increase diversity in the industry, executives said during a panel discussion Thursday at the Wholesale Specialty Insurance Association’s Annual Marketplace in San Diego.

The industry needs to be diligent and understand that a diverse workforce is going to bring more diversity of thought, said Carlton Maner, CEO and global property practice leader, U.S. division, for Axis Capital Holdings Ltd. in Atlanta.

Diversity and inclusion efforts increase productivity, and “profits at companies with a diverse background and diverse staff are much better than companies that lack diversity,” he said.

Mr. Maner is chair of the WSIA Diversity Foundation’s board of directors. WSIA established the foundation in 2020 to promote and attract diversity in race, gender, sexual orientation and disability and to influence progress in the diversity of the wholesale, specialty and surplus lines insurance industry.

Working in a diverse environment is both challenging and rewarding, said Cristi Carrington, Seattle-based principal, director of underwriting, at Brown & Riding Insurance Services Inc.

“It’s a challenge because when you’re workshopping a problem or doing a think tank, not everyone works like you,” Ms. Carrington said.

Everyone has their own biases in how they approach a problem, she said. “But to sit there and listen and have empathy for someone else, their background, life or their approach, is rewarding,” she said.

To drive diversity, equity and inclusion within organizations executives need to slow down, said Erin Dolan, senior vice president, analytics and communications, at RSUI Group Inc. in Atlanta.

“We talk about the unintentional bias that comes into all the decisions that we make, and I think that is going to be most prevalent when we’re going fast,” Ms. Dolan said.

“You were hired to go fast, to make decisions fast, so it’s important to slow down and be very intentional about what we do,” she said. Reaching out to people you wouldn’t normally reach out to for recruiting or ideas around a topic, is also critical, she said.

There is an opportunity to educate oneself and others when it comes to understanding the benefits of having a diverse workforce, said Bryan Clark, Los Angeles-based president of Gorst & Compass Insurance.

“We are not changing, we are evolving as a society, and we need to look at the world differently. … A lot of people still don’t get it and we’re here as leaders to show them it’s a big world out there full of amazingly talented people,” Mr. Clark said.

Increasing diversity in the industry will bring more talent to the industry, he said.

There is an internal pool of talent to be tapped to increase diversity within insurance organizations, Mr. Maner said.

“When we started our training program at Axis years ago, I said one-third of our trainees (should) come from college, one-third were people with more experience but not in the insurance industry, and one-third were from promotions from within. That has worked well for us,” he said.

The WSIA Diversity Foundation has started a speakers bureau with a goal of 18 campus visits to historically Black colleges and universities this academic year at which WSIA members will speak about their careers in the industry.

It will also focus on non-HBCUs with diverse student populations to increase the talent pipeline.

“We want to bring awareness to schools about our industry,” Mr. Maner said.

The panel was moderated by Adam Care, Austin-based business segment leader, vice president of CAD IoT, at Hartford Steam Boiler Inspection and Insurance Co.

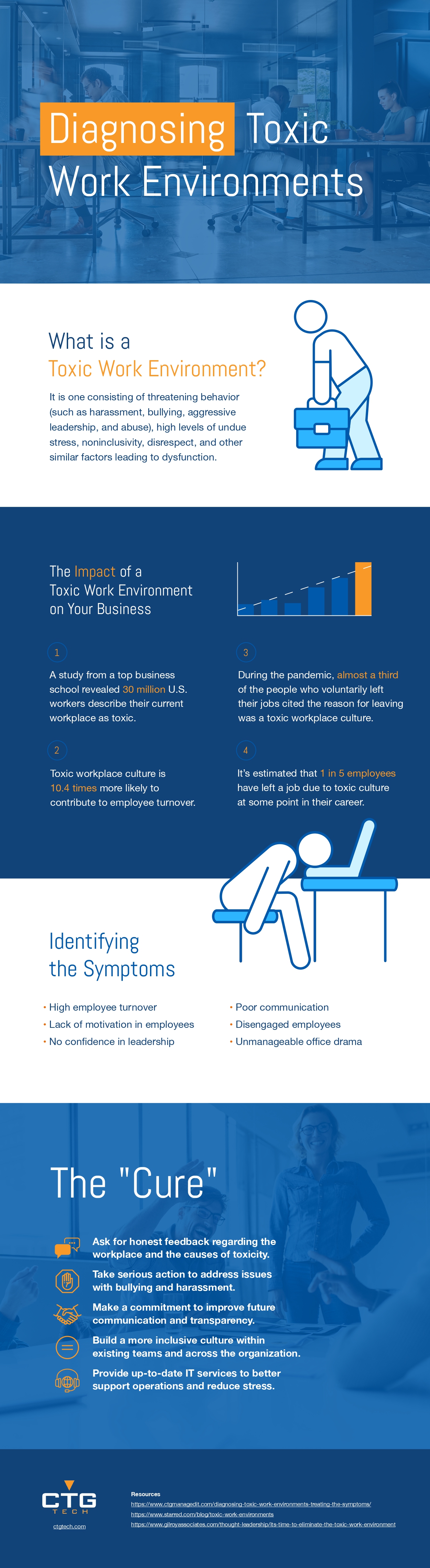

Good leaders should create and maintain a positive and diverse workplace. Please see the tips below for more help avoiding a toxic work environment and creating an inclusive one.

Provided by CTG Tech – managed it services Texas