Rethink Needed on How to Regulate Big Tech in Finance Services: BIS Official

A rethink is essential on how to straight regulate routines of Huge Tech companies in monetary companies, provided their dimension and influence, a top official at an worldwide forum for central banking institutions stated in Wednesday.

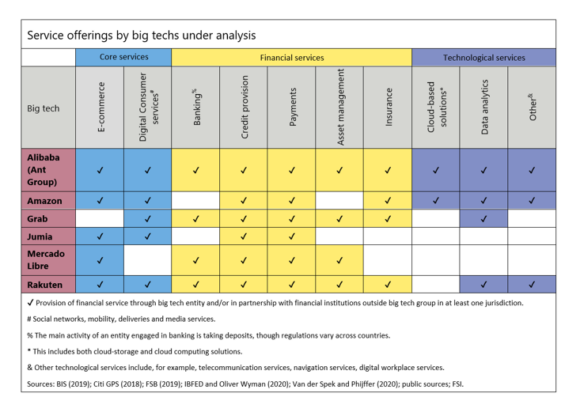

Knowledge-loaded Big Tech corporations these types of as Alibaba and Amazon have been involved for some time in financial providers such as banking, payments, asset management and insurance plan, with some also giving cloud computing to operate key providers for banks.

Their measurement and arrive at in social media and e-commerce indicates they can swiftly make up market share in monetary actions, Financial institution for Global Settlements (BIS) Common Supervisor Agustin Carstens mentioned in a speech.

This results in a possibility of them becoming “too major to fail” – a dilemma regulators hoped they had solved with banking institutions soon after bailouts in the money disaster above a ten years back.

“Without a doubt, a regulatory rethink is warranted, and we will need a new route to stick to,” Carstens reported, adding a new “holistic” framework was desired that integrated necessitating Large Tech economical services to be ring-fenced from other functions.

Their wide troves of information give Significant Tech corporations valuable information and facts about potential fiscal companies prospects, these types of as their prosperity and paying behavior. Companies from Jumia in Africa to Get in southeast Asia are seeking to tap into that by delivering solutions these kinds of as credit history and payments processing.

Significant Tech companies with sizeable money functions could also be topic to team-broad necessities on governance, perform of company and operational resilience, Carstens mentioned.

Applying “holistic” fiscal guidelines for Huge Tech would be complicated offered the sector is previously overseen by data privacy and level of competition regulators domestically and internationally, with no evident “lead” regulator, he additional.

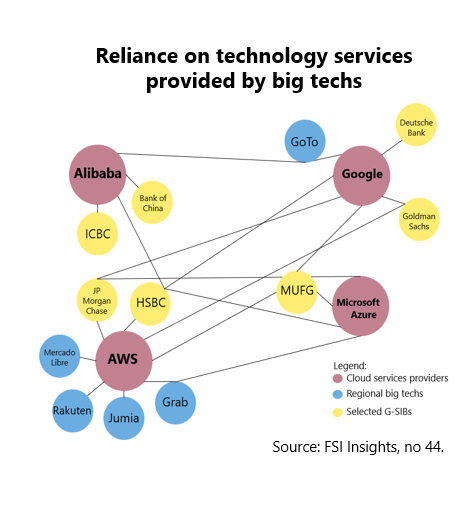

Operational resilience guidelines are now rising in the European Union, Britain and in other places to give money regulators oversight on the use by banking companies and insurers of exterior cloud computing corporations like Amazon, IBM and Microsoft to host solutions.

Microsoft’s $2 billion offer with London Inventory Trade Team in December was the most current sign of how boundaries in between Big Tech and finance are blurring.

The opportunity gains of Huge Tech firms’ entry into finance incorporate enhanced buyer outcomes, enhanced monetary current market performance and improved economical inclusion, Carstens explained. “It is substantial time to go from idea to apply and contemplate tangible alternatives for regulatory actions.”

(Reporting by Huw Jones modifying by Jason Neely and Mark Potter)

Matters

InsurTech

Tech

Interested in Insurtech?

Get automated alerts for this matter.