Teenager Promotes Financial Literacy in Youth with Personal Finance Education

Meet up with Daily Place of Gentle Award honoree Isaac Hertenstein. Examine his story and nominate an remarkable volunteer or family members as a Every day Place of Light-weight.

A lot of adults go away school and are stunned to uncover out how difficult taxes can be and don’t understand matters like how to commit in the stock market. Many thanks to Isaac Hertenstein, pupils in Greencastle, Indiana and further than are graduating with a bigger amount of financial literacy than at any time ahead of.

You never see many superior schoolers with a fiery passion for personalized finance, but Isaac, a sixteen-year-outdated runner and ethics enthusiast, breaks the mildew. Even in center college, his center university know-how and entrepreneurship trainer, Brittany Labhart, remembers observing his curiosity peaking.

“I saw in sixth and seventh [grade] that he was unquestionably interested in it, but in eighth quality I observed a substantial alter. Which is when we talk about small business and own finance,” she remembers. “He is an wonderful kid who has been driven from a pretty younger age”

The pretty following calendar year, Isaac resolved to share the understanding he found so intriguing with other folks. So, as a freshman in significant school, he formed his 501(c)(3), Pupils Educating Finance.

“A large amount of inspiration for Pupils Instructing Finance (STF) was from observing the financial inequality in my neighborhood and the influence of monetary literacy in combatting that as nicely as mending a hole in training,” Isaac suggests. “Indiana is not 1 of the 15 states that necessitates monetary literacy [as part of the curriculum].”

The states with the necessity commonly require learners to get at minimum a person semester of own finance in purchase to graduate from superior school. With this is head, Isaac took motion. Initially, he delved into dialogue with numerous local community leaders and economic and education and learning specialists. Then, he designed a 30-site curriculum for students from kindergarten by eighth quality with the mission to provide a foundation for results and to motivate young ones to look at economic professions. He also hopes to start discussions in between learners in the classroom and at residence.

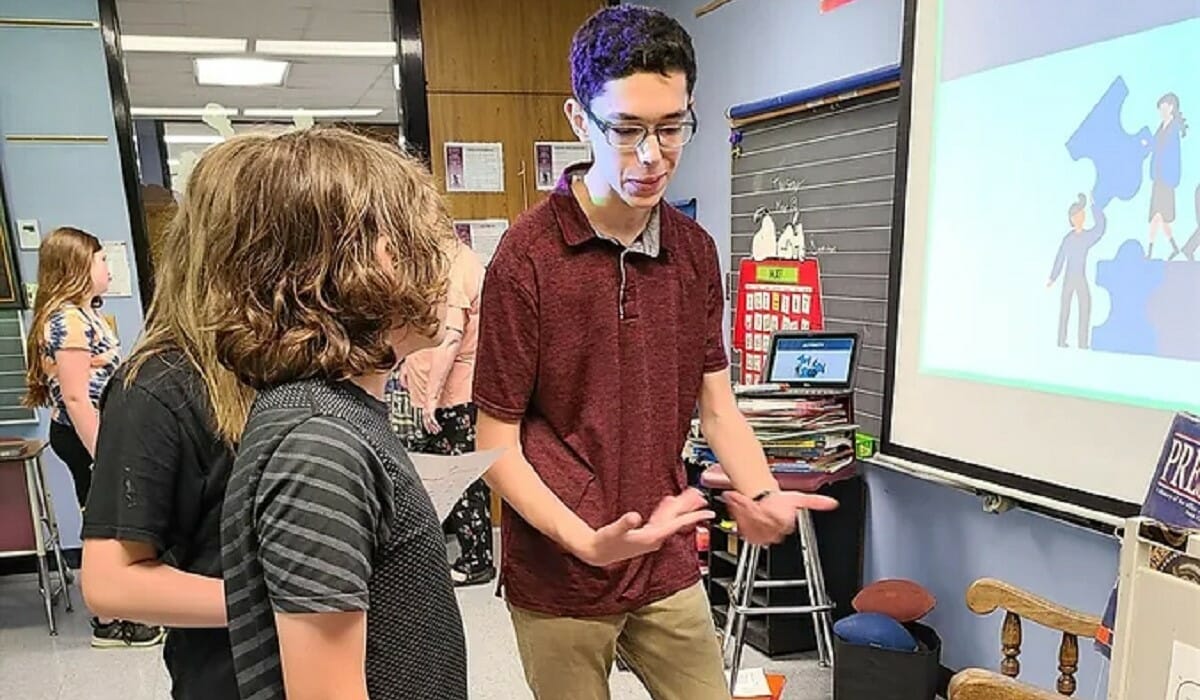

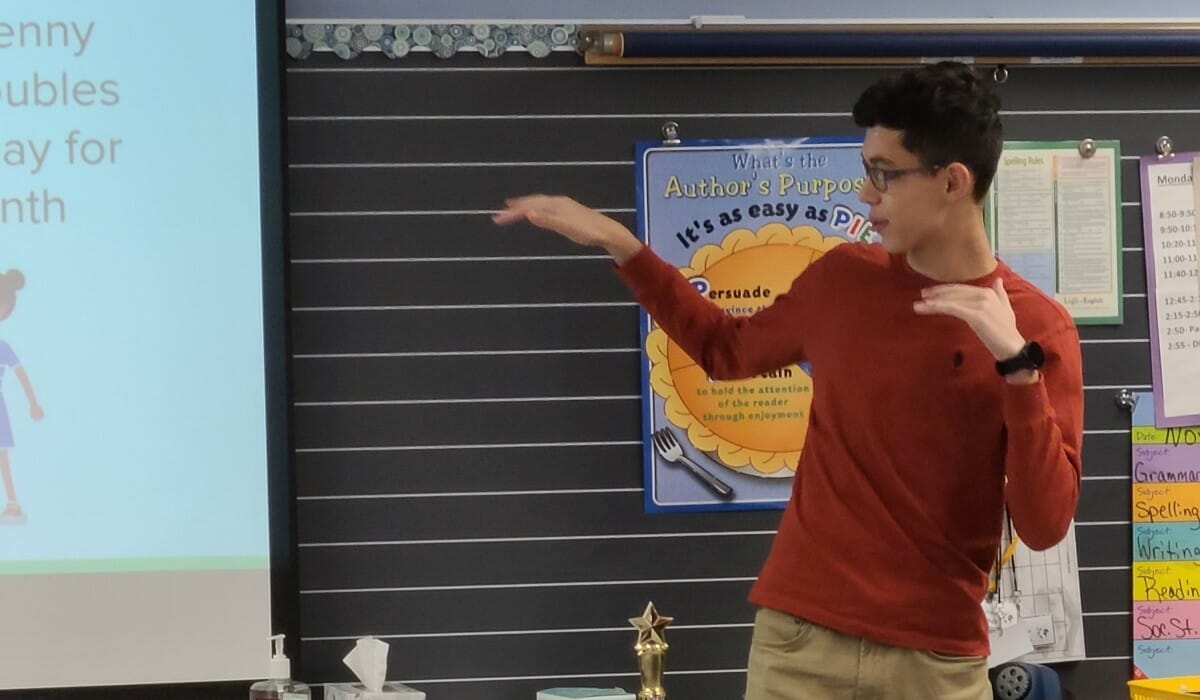

How does it operate? Isaac recruits volunteers amongst his peers to teach quick Lights Classes, just about every concentrating on an age-ideal core notion. Given that he started Pupils Instructing Finance, Isaac has taught around 575 college students in his hometown and has all over 30 volunteers teaching on a common foundation. These classes—and their teachers—leave lasting impressions.

“He begun off by inquiring them if they’d alternatively have so substantially revenue right now as opposed to so considerably in 10 several years, and he described how compound desire operates,” Brittany states of a lesson Isaac taught in her classroom. “It surely sparked dialogue afterward, and pupils had been definitely intrigued in what he experienced to say.”

Moms and dads can frequently be listened to telling volunteers that their children have been chatting about the classes for months afterward. Academics are also acquiring in line to implement his lessons on their own. Soon after functioning with Isaac for on STF for the past two years, the economics trainer at his large faculty applied his lessons in her curriculum for seniors.

And the enthusiasm is creating its way all over the place.

“I’ve labored with over 250 other volunteers about the place in 14 diverse states who have applied this curriculum and commenced chapters of Learners Instructing Finance in their communities,” Isaac suggests proudly. “ I’m attempting to unfold economic literacy and commence chapters in other superior colleges. Of system, just one of our primary ambitions is advocating for financial literacy legislation.”

Aiming to have a systemic effect, Isaac and STF has been in talks with several advocacy teams marketing fiscal literacy laws in Indiana.

“In this article in Putnam County, we have a fairly superior poverty price, and to instruct youngsters at all ranges the worth of own finance with basic ideas that it’s possible they are not receiving at residence, he can support them to make clever selections in the potential,” Natalie states.

Isaac cites that developmental researchers have proven that young ones begin forming a financial mentality at age five.

“They observe quite a few of the fiscal expending and saving behavior that their dad and mom and people today bordering have them, and they subconsciously undertake all those practices,” he states.

Isaac hopes his courses and emphasizing the time worth of revenue will aid get ready people kids as they get more mature and deal with economical issues like paying for faculty and retirement. Sad to say, not anyone is so fortunate.

“In accordance to a research from UPenn Wharton, which arrived out about 5 yrs ago, one particular-thirs of economic inequality is prompted by–not just joined to–differences in monetary literacy,” he cites. “Financial disparities and expertise definitely catalyze a substantial big difference in economic output and effects in the pretty conclusion. A great deal of it has to do with financial sector inclusion and setting up up belongings in excess of time.”

Impressed by his mom, a very first-grade teacher who styles the minds that will have favourable influence on the long term, Isaac is pretty forward-wondering. As he seeks to build a vocation at the level exactly where ethics, small business, and social effect blend, he typically thinks of the potential of his business. He hopes to grow STF’s attain by teaming up with FinPro Entire world, a company that results in on the internet discovering courses for middle to higher university-aged students, as nicely as recruit more faculty-aged volunteers to educate.

“72{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of mother and father do not talk to their youngsters about money.” Isaac suggests. “Finance is from time to time a taboo matter, but it is these an vital principle that lots of men and women disregard when meeting other people, and if they have been to examine it, it would actually just catalyze a lot more finding out for all people.“

Do you want to make a big difference in your group like Isaac? Come across area volunteer prospects.