The Most Profitable Listicle in Personal Finance History! | by Joseph Seifert | Mar, 2022

Do you dare to change your life financially? Start here…

Ever since I got my start in self-directed personal finance, I felt an urgent need to assemble the greatest collection of assets that is humanly possible.

I can’t be the only one who subscribes to this necessity so I’m sure a few of you have spent a little too long in a daydream at least once before.

Besides, who wouldn’t want to have a financial arsenal that rivals the world’s richest? Not this guy (me)!

If by chance, you haven’t dreamt of your financial “once upon a time,” you’re about to find some brilliant inspiration and even a good idea of where to begin.

Self-directing your finances can be extremely profitable and insanely fun at the same time!

Without further ado, I present to you what very well could be…

Every good listicle must come with an epic starting point. That is no doubt the case here today, so allow me to introduce what I think should be the first investment on everybody’s financial bucket list.

The Roth IRA

If you guessed it, let me know down in the comments.

The Roth IRA was indeed my first investment of choice and for very good reason. Let me share with you the power of this investment vehicle!

Important distinction: I use the word “vehicle” for a reason. A common misconception among those who are not familiar with retirement investing is that the Roth IRA is the investment. As a matter of fact, it is not. A good way to think about it is similar to shopping at the grocery store. The Roth IRA is your shopping cart, and you need to choose which investment products you want to hold inside your cart! Simple, right?

I would hate for you to open a Roth IRA thinking you will wake up a millionaire one day only to realize the money is sitting there stagnant. Believe it or not, I’ve heard stories about this happening.

The Roth IRA is an individual retirement account (IRA). It’s funded with post-tax money which means you have already paid Uncle Sam. Since you were so nice to give him your hard-earned dough upfront, he will allow your investments to grow handsomely, tax-free, AND allow you to access your funds, again, tax-free!

After age 59 and 1/2 that is…I know, I know. I can already hear you screaming.

“59 and 1/2 years? That’s so old!”

Yes, I agree that is a relatively late age to access the money penalty-free, but at the end of the day, it is a retirement account. The reason to start investing so early (I just turned 22) is to take advantage of what Albert Einstein likes to call the eighth wonder of the world: Compounding. Or in this case, compound interest. This is one of my favorite concepts in the world of investing and I think it will soon be yours too.

Allow me to show you something…

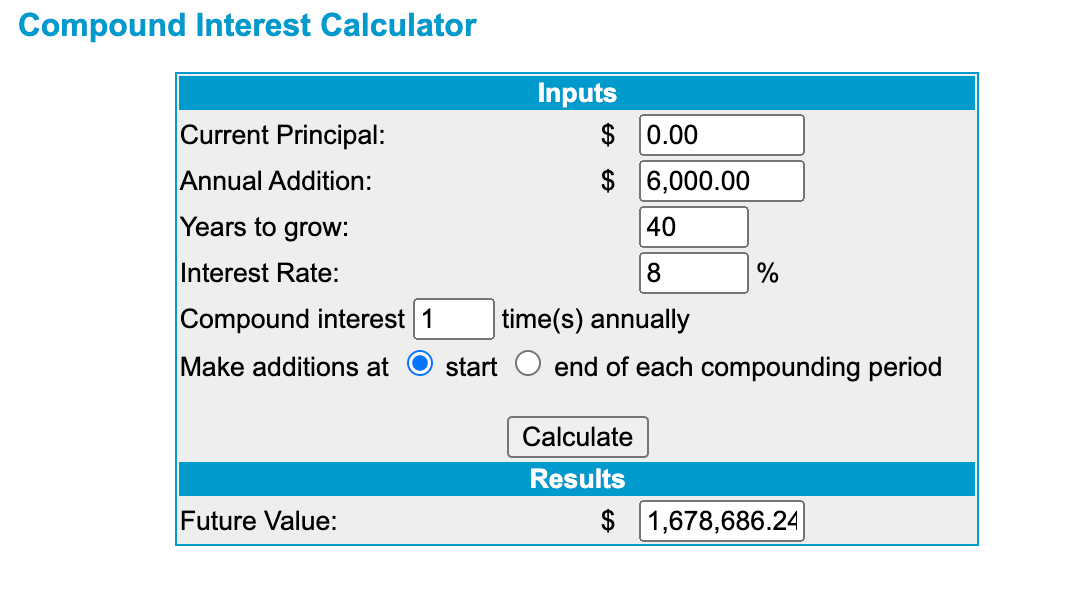

This is a compound interest calculator from my friends over at Moneychimp.

You can see that if we start with $0 and contribute the current maximum annual investment of $6,000, compound it over 40 years at an average rate of 8{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}, we end up with the princely sum of $1,678,686.24. Not bad, huh?

This assumes that we start at 20 years old and stop at age 60. Leave it in for a few more years and that account value could easily be over 3 million. That’s the beauty of compounding baby!

The Roth IRA is an epic first investment and I’m so glad I jumped on board.

Cryptocurrencies

Now that we have the stock market box checked off, we need some dirty, filthy, crypto tokens.

I’m kidding, I’m kidding. Microcap crypto coins are not my thing.

I am a big believer in blockchain, however, and I think cryptocurrencies have an immensely bright future. I’m a fan of Bitcoin, Ethereum, and a few of their other counterparts, but even these are not my saving grace in terms of financial security.

Right now, you can hold something called a stablecoin. These are cryptocurrencies that aim to hold the value of the dollar. The best part? You can earn crazy interest on them at places like Voyager. They will currently give you 9{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} on your USDC (my stablecoin of choice). 9{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}! Try asking your brick-and-mortar bank for that and I think they would slap you across the face.

These cryptocurrency brokers will even pay you interest on other coins like the popular Bitcoin and Ethereum. I love having crypto as my accessible money multiplier. It’s riskier than the traditional stock market which is why I hold my stocks inside my tax-sheltered retirement account. With crypto, I can have my petty cash growing while I’m out earning even more money to place inside my financial system. It has proven to be a wonderful addition!

Real Estate

This is where we commence the mental movies. I have yet to acquire a real estate property so from here on out I will be highlighting my future ambitions.

If I were to get into the real estate game, I would wish to purchase a multi-family home. These are great because if you didn’t know, you can do something the F.I.R.E. community likes to call; house hacking. House hacking is when you buy say a duplex (two-family home) and live on one side while renting out the other. The goal here is to offset the mortgage payment with the recurring rental income.

There is a lot to consider here because the deal has to be right for it to work and you may have to crunch some numbers. I never said the most profitable listicle in personal finance history would be a cakewalk. If you can pull this off — which many people do — it can prove to be one of your most valuable investments. Eventually, when you wish to move on or the house is paid off, you can realize rental income from both sides of the property and live lavishly with your money-making machine!

Side Hustle

A lot of people don’t see a side hustle or personal business as an investment option. I often fall into this category myself, while most others also believe that an investment must be a money trade. For a business, you will most likely invest some money but you will also invest another more valuable resource: Time. Investing time and money into a business is not a sure-fire way to experience financial success, but if you can manage to create a successful empire you will be far ahead of the pack.

This is essentially what I am trying to do with my online writing. Side hustles are great because they can be paired with a 9 to 5! That means double the income and double the cool points! If your side hustle becomes successful enough, you may even be able to quit that 9 to 5 and make your side hustle your main hustle!

Family Bank

This is the fifth and final component of the most profitable listicle in personal finance history.

I saved the best for last and this one is quite riveting. I recently wrote an article about the family bank, so if you would like an in-depth review of its power, check that out.

The basis of a family bank is a holding cell for your capital. It needs to have some key characteristics though. I like to look for liquidity, safety, and a good rate of return. That would make me happy if I had all three. Luckily, you can experience those traits with a family bank. The core of your bank is a whole life insurance policy. It has to be structured properly by a professional so this is something you’ll need a little help with. Don’t worry, you are still in the driver’s seat of your self-directed investments.

The insurance policy allows you to deposit funds on a schedule set by you, and it will experience a specified rate of return. The real power comes from the fine print, however. If you want to leverage this strategy to your benefit, you can take loans out against your policy and since you are the holder, you can pay yourself back at any time! The best part? You’re not even borrowing your own money. It’s technically from the insurance company and your account value will continue to earn that rate of return, doing its thing. If you never pay back the loan it will come out of your death benefit but that’s up to you (I would pay it back for maximum advantage).

If you didn’t already know, this is essentially what your brick-and-mortar bank does with the money you deposit into your savings. Why not copy them and do the same? There are tons of benefits to this strategy and I’m only beginning to realize them.

My goal with assembling this team of “financial avengers” is to find the best “holding cells” for my money.

There are many things to think about when combining different investment vehicles like diversification and potential for risk. Everyone’s ideas and situations will be different so it is up to you to figure out how you would like to play the money game.

I believe that simplicity is key but I also have a good time complicating things gunning for ample returns. We can all daydream about our future riches but it’s also important to remain in the here and now.

After all, money is technically just paper and it shouldn’t dictate our entire lives. Keep a healthy philosophy when it comes to personal finance and I think you could live a life that is wealthy and wise.

Take a good look at these investment options, and bring whichever ones you like back with you. Dive headfirst into the minutia of their unique characteristics and it may even lead you elsewhere.

Investing is a very good thing to make a habit of and can have a major impact on the lives of ourselves and our loved ones.

Now get out there and go invest!

**Note: This is not financial advice. Just my financial thoughts and interests.