These states poised to pass personal finance education laws this year

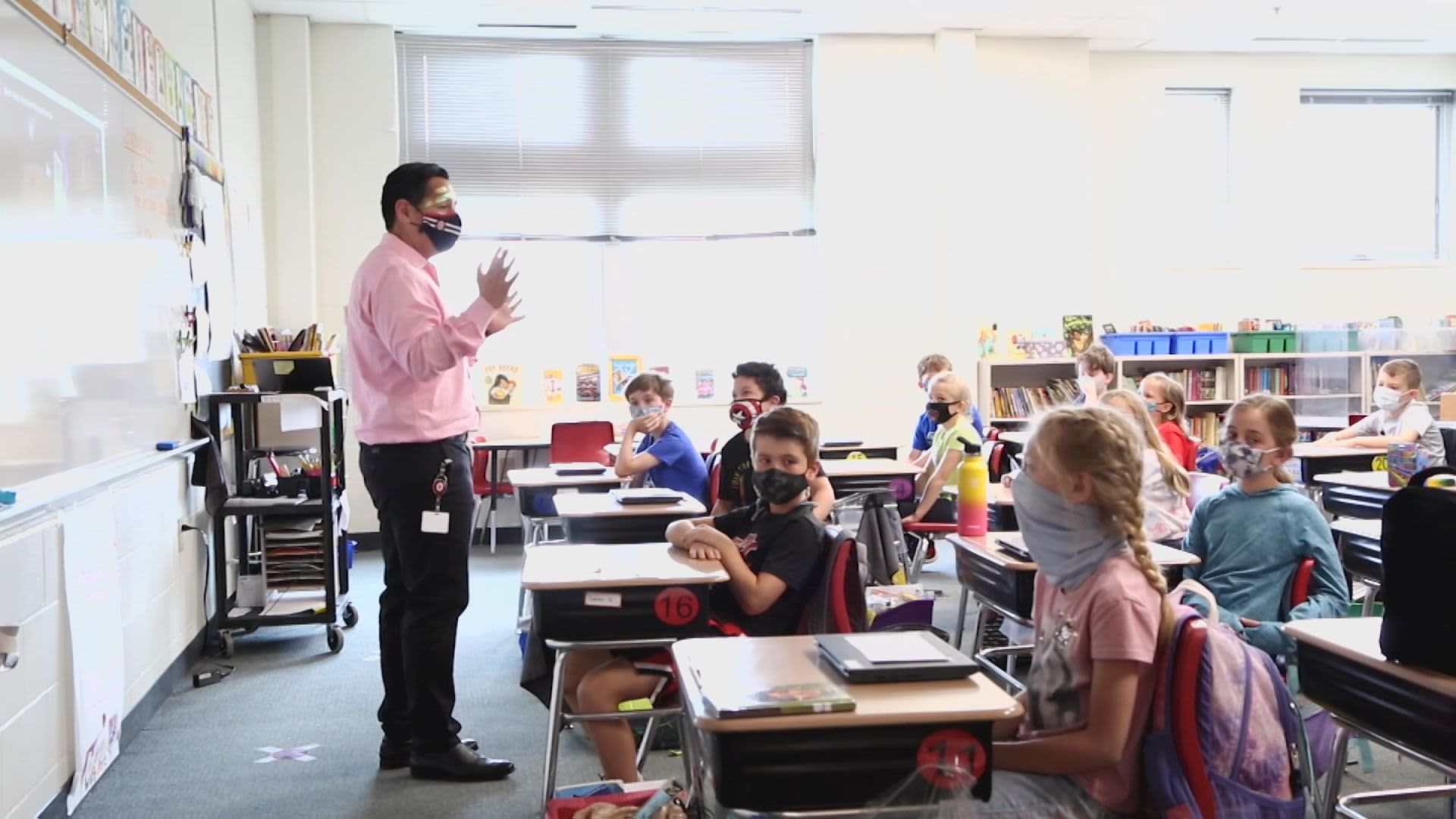

Lee Jimenez, a trainer at Indian Hill Elementary School in Cincinnati, Ohio, discusses credit history playing cards and strategies of payments with his 3rd quality course using on the web financial education and learning curriculum SmartPath.

SMARTPATH

There is certainly momentum for personalized finance education getting to be legislation in lots of states across the country.

Just about 50 {1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} the states currently mandate these instruction, and much more states could go legislation this year to make certain college students, specifically all those at the high faculty stage, have it prior to they graduate.

“It can be been a massive improve,” reported John Pelletier, director of the Centre for Economical Literacy at Champlain College in Burlington, Vermont.

Right before the coronavirus pandemic, progress on personalized economic schooling had stagnated, he explained. But amid pandemic layoffs and the ensuing economic downturn, it grew to become crystal clear that money literacy is extremely vital for learners.

“What appears to be to propel these costs forward is a catastrophe,” Pelletier reported.

Who is following

Ga will probable be the future point out to move a own finance schooling requirement, in accordance to Future Gen Personalized Finance, a nonprofit group.

The two chambers of the state’s common assembly have passed a bill, SB 220, that would require all superior faculty college students to consider at minimum a fifty percent-credit rating money literacy system in order to graduate, starting up with the 2024-25 school yr. The invoice is awaiting the governor’s signature to turn into legislation.

South Carolina also may possibly soon move laws mandating private finance schooling. The state has a bill, S16, that’s at the moment in conference committee. After Georgia’s bill is signed into regulation, South Carolina will be the only condition in the Southeast that won’t need personal finance coursework, in accordance to Tim Ranzetta, co-founder of Up coming Gen Individual Finance.

“I consider you can find an component of [fear of missing out] taking place concerning the states,” explained Ranzetta. “Which is why we are looking at the trend there.”

Far more from Devote in You:

How to decide if you really should hire or have a house

U.S. households are spending an additional $327 a month due to inflation

Is inflation crunching your funds? In this article are 3 means to battle back again

Michigan could also progress laws in the coming months. A invoice that would require a 50 {1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}-credit score personal finance course for high faculty graduation handed the point out Property of Representatives in December and is predicted to be taken up by the condition Senate in Might.

In Minnesota, an omnibus training bill would mandate that higher college freshman starting in the 2023-24 college 12 months just take at minimum a half-credit history personal finance study course to graduate. And, in New Hampshire, an training monthly bill involves particular finance on a list of issues that constitute an sufficient education and learning.

Overall, 23 states in the U.S. have some kind of private finance education and learning mandate, according to the 2022 Survey of the States from the Council for Economic Education. And 47 states include things like language about personal finance in their condition education standards, nevertheless a lot of never have necessary programs.

Upcoming Gen Particular Finance reported that, so considerably, 12 states satisfy its gold regular of personal finance education, meaning that they have to have or will shortly call for at minimum a fifty percent-credit, standalone individual finance class for substantial faculty graduation.

A popular class of research

Data displays that learners and their mother and father want enhanced personal economical education and learning readily available in community universities.

In California, Florida, Georgia, Michigan and South Carolina, 80{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} or far more of those surveyed supported owning economic literacy programs, according to Future Gen Personalized Finance.

In a lot of states, laws has also been handed with bipartisan help, often overwhelmingly from equally sides of the political aisle. In Florida, for example, the bipartisan laws was passed unanimously in March.

“It can be just one of individuals widespread sense troubles that cuts throughout political events,” mentioned Ranzetta.

What’s upcoming

Some mothers and fathers say it is their accountability, not the schools’, to instruct their children about dollars. But number of are carrying out the operate, and numerous mother and father have not had sufficient personalized finance instruction by themselves.

That leaves it up to state schooling boards to include things like particular finance schooling in legal guidelines.

So significantly in 2022, 61 bills about private finance training have been proposed in 26 states, in accordance to Subsequent Gen Own Finance. Of people, 47 expenses throughout 20 states are however alive, that means they could sometime grow to be regulation.

In addition to encouraging laws mandating money literacy courses, advocates are searching at the quality of each individual bill proposed and whether they incorporate trainer training. This is an critical piece of the puzzle, as students want confident, skilled instructors who can describe finance.

“Instructors want to be educated in own finance so they can give their college students the ideal,” reported Michael Sheffer, director of education and learning at FoolProof Foundation, which offers no cost financial education curriculum for learners and instructors.

The improved appetite for personal finance programs has served get much more quality schooling to lecturers, a pattern that is most likely to keep on, he said.

They are properly on the way to producing that a fact, in accordance to Sheffer.

“This is a snowball operating downhill now, and it is acquiring bigger and greater,” he explained.

Indication UP: Dollars 101 is an 8-week mastering course to financial independence, delivered weekly to your inbox. For the Spanish model, Dinero 101, click right here.

Check out OUT: 74-calendar year-old retiree is now a design: ‘You will not have to fade into the background’ with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are buyers in Acorns.