What are current personal loan rates?

Our purpose here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” under, is to give you the equipment and self-assurance you require to strengthen your funds. Whilst we do boost products from our spouse creditors who compensate us for our expert services, all viewpoints are our very own.

The fee you get on a loan establishes your month to month payment total and total value of borrowing funds. (Shutterstock)

A private mortgage can help you deal with just about any price. Whether you need to have a personal loan to consolidate debt, pay a professional medical bill, or fund a property improvement project, it could be a great time to borrow dollars when desire rates are minimal. Dependent on your credit score and funds, as nicely as the type of bank loan you select, you could be ready to conserve some income on desire rates and minimize your general charge of borrowing.

Go to Credible to see your prequalified personalized bank loan premiums from a variety of lenders, all in a person put.

What are current particular mortgage premiums?

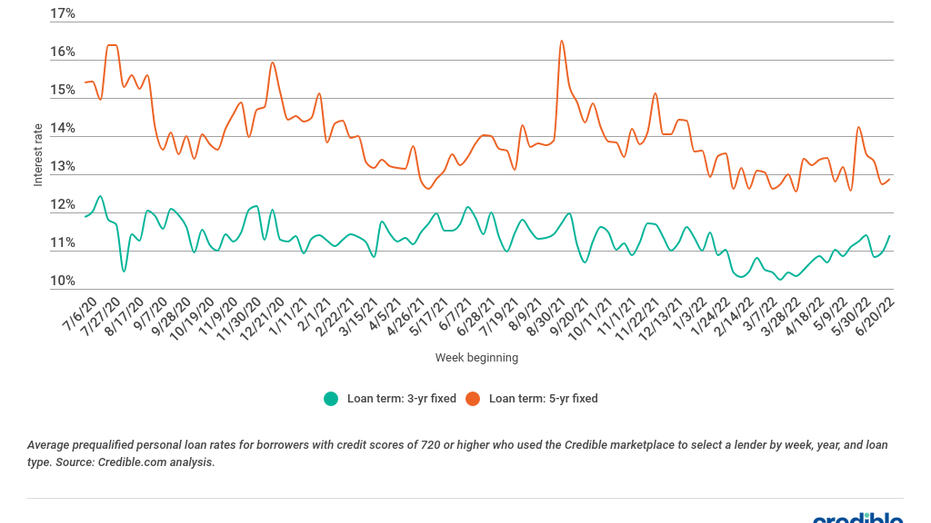

The chart under shows typical prequalified individual loan charges for borrowers with credit rating scores of 720 or better who used the Credible market to select a financial institution:

For the month of June 2022:

- Prices on 3-calendar year individual financial loans averaged 11.08{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}, down from 11.14{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} in May.

- Costs on 5-yr private financial loans averaged 13.10{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}, down from 13.27{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} in May possibly.

How has inflation impacted private personal loan premiums?

The existing inflation fee in the U.S. is 8.26{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a}. Although it has slowed a bit, it is nonetheless near to the maximum it is been in 40 decades. Because inflation prospects to bigger charges on merchandise and expert services, the desire for credit rating boosts, primary to increased desire rates for new particular loans and other monetary items, like home loans and credit history playing cards.

Though this rewards loan companies, it means that you are going to spend more to borrow dollars. If you have a current bank loan with a mounted curiosity level, your payments will not be influenced. But if your mortgage has a variable fee, your payments could go up.

Credible makes it uncomplicated to compare personalized financial loan fees from many loan providers, with no affecting your credit.

Typical personal financial loan premiums by credit rating rating

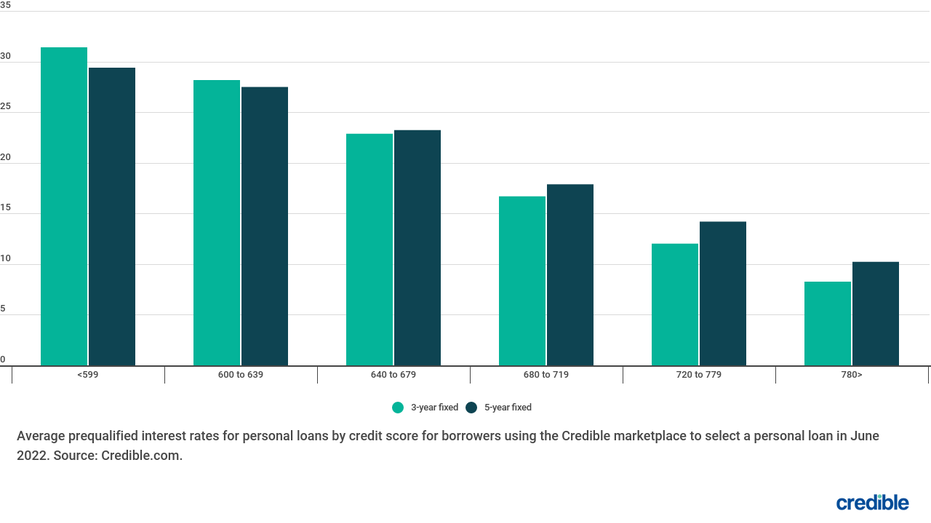

Typical own personal loan rates can fluctuate based on your credit rating and other monetary things. The chart underneath displays normal personal loan costs by credit rating rating:

In June, the ordinary prequalified level chosen by debtors was:

- 8.26{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} for borrowers with credit scores of 780 or earlier mentioned selecting a 3-yr mortgage

- 30.44{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} for borrowers with credit rating scores under 600 choosing a 5-12 months financial loan

How to get a lower personal financial loan interest price

The good news is, you can just take methods to lock in a lower fascination fee and potentially preserve hundreds or even 1000’s of pounds in interest on your private bank loan, such as:

- Maximize your credit score rating. The larger your credit history rating, the reduce prices you will qualify for. To make improvements to your credit, check your credit report and dispute any errors, pay your costs on time, shell out down personal debt, and don’t open new credit accounts except you basically want them.

- Opt for a shorter compensation term. In general, shorter mortgage repayment terms appear with reduced curiosity premiums. If your regular budget allows for it, implement for a shorter time period of two years in its place of five several years, for case in point.

- Get a cosigner. A cosigner, which can be a family member or close mate with great credit score, can support you land a lessen curiosity rate. Just keep in mind that if you fall short to make your bank loan payments, the cosigner will be responsible for them.

- Shop about. Not all personalized financial loans are designed equal. Do your exploration and assess presents from a number of distinctive lenders to come across the most competitive rates.

With Credible, you can immediately and simply compare private financial loan costs to locate 1 that fits your requires.