What’s the average cost of homeowners insurance?

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

The average cost of homeowners insurance varies by state and the amount of coverage you need. (Shutterstock)

Homeowners insurance typically pays to repair or replace your home in many cases if it’s damaged by a fire, crime, or another unexpected event.

The price you’ll pay for your policy can vary significantly based on a number of factors, including where you live. This article covers what those factors are, as well as the average cost of homeowners insurance.

You can easily compare homeowners insurance quotes with Credible.

What’s the average cost of homeowners insurance?

The average cost for homeowners insurance across the U.S. is $1,251 per year, or $104.25 per month, according to National Association of Insurance Commissioners data.

This figure has been on the rise in recent years. That’s because of an increase in home repair and rebuilding costs, higher catastrophe losses due to extreme weather, and more people relocating to disaster-prone areas.

Your actual cost of homeowners insurance can vary widely based on the specific type of policy you choose, your location, and a host of other factors.

Factors that affect the cost of homeowners insurance

Your quote for a homeowners insurance premium takes many factors into account, including:

- Age of the home — Newer homes may have lower insurance costs than older homes. If a home is particularly old, you may struggle to find adequate coverage.

- Type of construction — Your house’s construction style can affect its risk of being damaged in a fire or storm. Frame houses, for example, may be more expensive to insure than brick homes.

- Location — The setting of your home can affect the price of insurance in either direction. For example, homes in urban areas may face a higher risk of crime, but have better fire protection services — while homes in rural areas may have the opposite dynamic. The quality of your area’s fire department is particularly important to homeowners insurance companies. Your city may have a fire protection class rating that insurers use to set prices.

- Deductible — A deductible is the amount you pay toward a repair before insurance kicks in. The higher your deductible, the lower your premium tends to be, but the more money you pay out of pocket when you file a claim.

- Amount of insurance coverage — You’ll want to buy enough insurance to cover the cost of replacing your home in the event of a total loss, making your total coverage highly dependent on real estate and construction costs. The more coverage you need, the higher price you’ll pay.

- Risk of natural disasters — Certain parts of the country are more prone to disasters like hurricanes, brush fires, and tornadoes. These areas may require you to pay higher premiums.

- Local laws and regulations — Homeowners insurance is heavily regulated, with rules varying from state to state that can affect insurance costs. Certain states may require specific levels of coverage, which can increase your cost.

- Your claim history — If you’ve filed numerous homeowners insurance claims in the past, you may face higher costs when you renew or purchase a new policy. This can happen even if the claims you filed weren’t your fault.

Average cost of homeowners insurance by state

Here’s the average cost of homeowners insurance in the U.S. by state, according to the National Association of Insurance Commissioners:

What are the most expensive states for homeowners insurance?

The most expensive states for homeowners insurance all lie on the Gulf Coast, an area at particular risk for hurricanes. All three states have been hit hard recently, with homeowners incurring billions in damages.

- Florida — $1,954 average annual premium, or $162.83 per month

- Louisiana — $1,906 average annual premium, or $158.83 per month

- Texas — $1,878 average annual premium, or $156.50 per month

What are the least expensive states for homeowners insurance?

The three states with the least expensive homeowners insurance aren’t in areas traditionally prone to hurricanes or tornadoes. Their premiums are less than half the average premiums in the most expensive states.

- Oregon — $731 average annual premium, or $60.92 per month

- Utah — $737 average annual premium, or $61.42 per month

- Idaho — $787 average annual premium, or $65.58 per month

Visit Credible to compare homeowners insurance quotes from various carriers, all in one place.

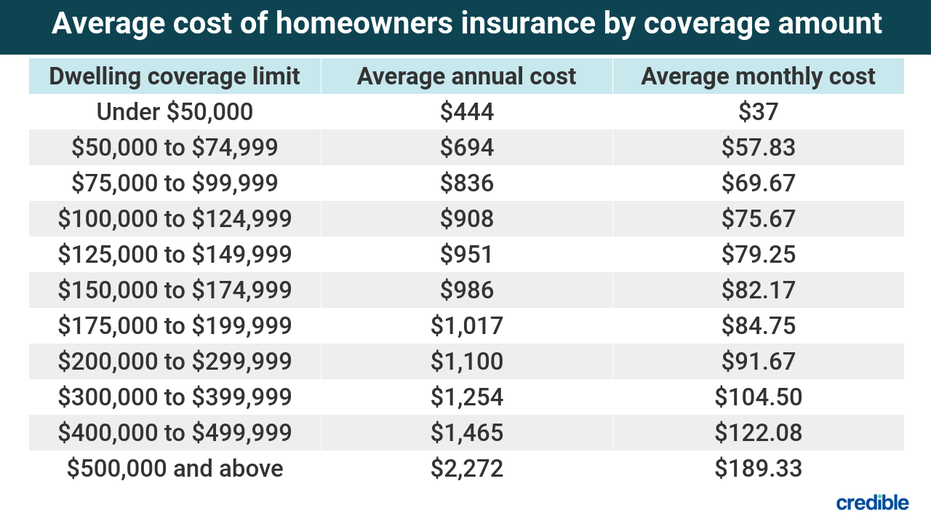

Average cost of homeowners insurance by coverage amount

Homeowners insurance policies generally have a dwelling coverage limit, or the maximum amount an insurance company will pay out to repair or replace a damaged house. More-expensive homes require you to buy a higher dwelling coverage limit, which can have a major effect on your premium.

Here’s the average cost of homeowners insurance by coverage amount, according to the National Association of Insurance Commissioners:

How to lower the cost of homeowners insurance

If any of the average prices give you sticker shock, keep in mind that it’s possible to lower the cost when you buy homeowners insurance. Consider these strategies:

- Bundle multiple insurance policies. You may have a number of different insurance policies, including auto insurance, life insurance, and business insurance. Some insurance companies may give you discounts if you choose to have multiple policies with the same company, which is called bundling.

- Take advantage of discounts. Some insurers will give you a discount on your policy if you do things like install a security system or sprinkler system.

- Increase your deductible. The higher your deductible, the more you’ll pay out of pocket if you file a claim — but the lower your insurance premium will be.

- Shop around. Once you determine the level of insurance coverage you need, you can get quotes from multiple companies. You may find that the price is significantly cheaper from one insurer to another. Just be sure you’re comparing similar policies.

Homeowners insurance FAQs

Read on for the answers to a few of the most common questions people have about homeowners insurance.

Why does homeowners insurance go up?

The cost of your homeowners insurance may rise over time for a variety of reasons, and some of them are specific to your home. Your homeowners insurance may also get more expensive as your home ages, for example, since older homes tend to be more at risk of damage. You may face a higher premium if you have a history of filing homeowners insurance claims, even if they’re for issues that weren’t your fault.

Plus, factors beyond your home can influence rising prices. One of them is inflation: The price of construction, materials, and other items you’d need to repair or replace your home goes up over time, so your insurance does too. Your policy may automatically increase its coverage (and likely its cost) to keep up with overall inflation. Homeowners insurance rates may also go up in your area if your town has been hit by an unusual number of natural disasters or other catastrophes recently.

Does homeowners insurance affect your mortgage payment?

Yes, in a way. You typically won’t pay your homeowners insurance company directly for your policy. Instead, you’ll pay for your homeowners insurance as part of your monthly mortgage payment, with your lender holding the money in an escrow account and making the premium payments on your behalf. This allows the lender to ensure your homeowners insurance is paid on time, protecting its investment as well as your own. If the cost of your homeowners insurance goes up, so will your mortgage payment.

What’s not covered by homeowners insurance?

Homeowners insurance policies generally spell out when damage to your home will be covered and when it won’t. (It usually depends on what caused the damage.) In most cases, your policy will cover damage from fire or storms but won’t cover flood damage or earthquakes. Your policy may or may not cover damage from hailstorms or windstorms.

Wear and tear is generally not covered under a homeowners insurance policy. Your vehicles generally aren’t covered, even if they’re damaged in an event that also damages your house, and your pets aren’t covered either.

You can usually see what’s not covered under your policy in the “exclusions” section, or you can speak with your insurance agent to find out.

With Credible, you can compare homeowners insurance quotes from different carriers in minutes.