34{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of Gen Z Is Learning Personal Finance From TikTok and YouTube, Survey Finds

pressureUA / iStock.com

Generation Z has grown up in an age of low commissions and high technology, which has greatly influenced how they invest and learn about money in general. This generation that is between 6-24 years old right now is trying to use what they grew up with — things like social media — to their advantage instead of just for fun. While previous generations might’ve relied on family, financial advisors or other sources to learn about money management, Gen Z appears to be modernizing personal finance education in a way that works for them.

Read: 51 of the Biggest Money Influencers on TikTok and YouTube

Check Out: The 10 Best Stocks for the Gen Z Investor

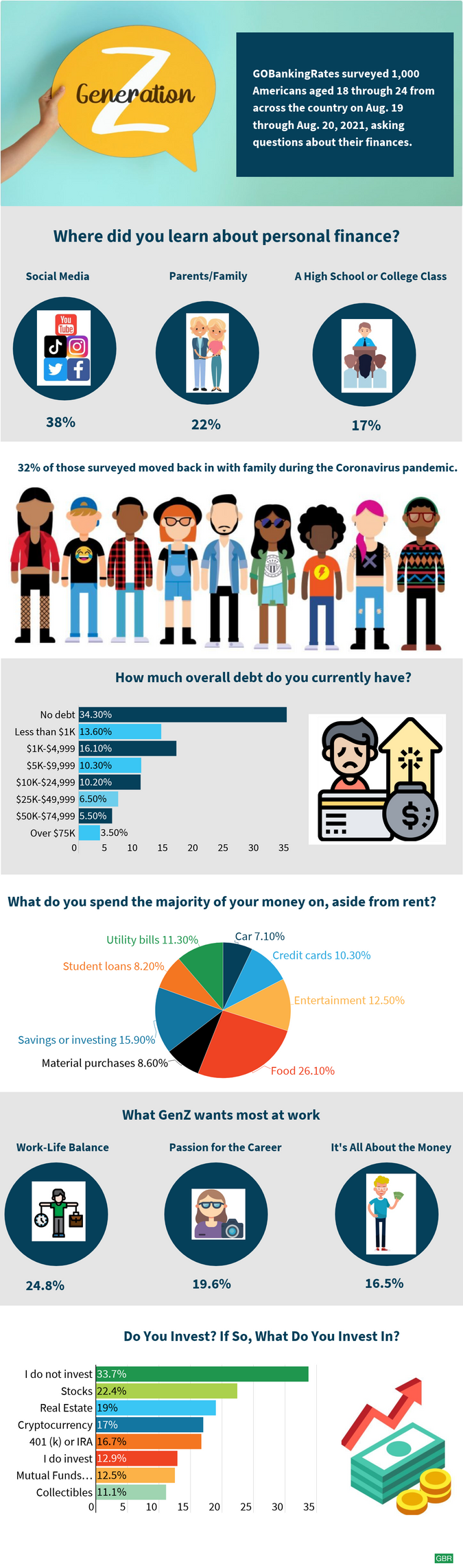

To find out about Gen Z’s approach to personal finance, investing and more money issues, GOBankingRates commissioned a six-question study of 1,000 Americans ages 18 to 24. Here are some of the most interesting results from that survey.

Gen Z Learns Personal Finance From TikTok and YouTube

Perhaps the most notable result from the survey is that the younger generation gets a lot of its financial information from a source that didn’t even exist two decades ago. A whopping 38.8{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of Gen Zers responded that they learned about personal finance from TikTok, YouTube or other social media outlets, like Twitter or Instagram — 34.3{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} answered TikTok and YouTube specifically. An additional 7.20{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} responded that they get their information from personal research and/or online forums like Reddit. Combined, that’s far more than the 22.70{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} who reported learning from parents or family.

A lot can be inferred from this statistic. For starters, it reflects how much social media and online information dominates the lives of Gen Zers. However, it also raises questions about the quality of information that Gen Zers are getting about personal finance. While there is certainly some valuable information to be found online, there aren’t many restrictions as to who can post online and what they can say. If Gen Zers aren’t vetting the information they’re receiving, they could be susceptible to financial misinformation. It also means they might be missing some of the fundamental principles about personal finance along the way, as only 17.60{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} indicated they learned their financial information from a high school or college class.

Find Out: 5 Financial Steps Gen Z Should Be Taking Now

See: Surprising Ways Gen Z and Millennials Are Worlds Apart Financially

A Surprisingly High Percentage of Gen Zers Invest in Real Estate

For the purposes of this survey, only those ages 18-24 were included. Typically, people in that age range are either finishing up their education or working their first jobs. In either case, Gen Zers haven’t had a lot of time yet to build up their savings and investment portfolios. Yet, a surprising 19{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of respondents indicated they were invested in real estate, which traditionally requires higher levels of investment and/or a good credit history. This was the second-most popular investment category of survey respondents, just behind the 22.40{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} indicating they were invested in stocks.

Sponsored:

Take Control of Your Finances: You work hard for your money. It’s time to make your money work hard for you. Schedule a free call with a Certified Financial Trainer to get started!

Although a large number of Gen Zers in the survey indicated they were invested, 33.70{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} indicated that they were not invested in anything. This represented the single largest individual response to this question. While many Gen Zers may not yet be earning a lot of money to invest, it would benefit them to begin saving and investing as young as possible to take advantage of the power of compound interest.

More: Crypto and 5 Other Groundbreaking Investing Trends for Gen Z

Find: How Will Teens and Gen Z Invest Their Money? Think Low-Risk, ESG and Roboadvisors

Debt Levels Are Generally Under Control for Gen Z

While it might be more encouraging to see a higher level of investment from the survey respondents, the good news is that most of the Generation Z survey respondents indicated they had control over their debt. More than 34{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of survey participants didn’t have any debt at all, including student debt, and nearly two-thirds had less than $5,000. However, 9{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of respondents had at least $50,000 in debt.

Find Out More: Life Events That Millennials and Gen Zers Are Choosing To Go Into Debt For

Many Gen Zers Still Rely On Their Parents

From the survey results, it appears that Gen Zers aren’t quite ready to completely stand on their own in times of trouble. During the pandemic, around two-thirds of respondents indicated that they lived with their parents. Although 13.90{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} indicated they have since moved out on their own, a full 49.30{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} indicated they either have always lived with their parents or moved back home during the pandemic and are still there.

Read: Gen Z Feels Financially Unprepared for Adulthood — But Has Hope for the Future

More: 4 Industries Gen Z Might Save — and 4 It Might Destroy

There Are Some Notable Differences Between Male and Female Gen Zers When It Comes to Personal Finance

When it comes to money and finance, there were some relatively significant differences between male and female respondents to the Gen Z survey. For example, 26.13{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of women indicated they learned personal finance from their parents or family vs. just 16.53{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of men. Men vastly preferred YouTube as a source of financial information, at 27.17{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} vs. 11.98{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} for women.

Women were also more likely to have zero debt, at 36.08{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} vs. 31.09{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of men, but they were also less likely to be invested: Only 25.77{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of men indicated they were not invested vs. 38.10{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of women. About 52{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of men indicated they were invested in cryptocurrency and/or stocks vs. just 32.50{1b90e59fe8a6c14b55fbbae1d9373c165823754d058ebf80beecafc6dee5063a} of women.

More From GOBankingRates

Last updated: Sept. 15, 2021

Methodology: GOBankingRates surveyed 1,000 Americans aged 18 through 24 from across the country on Aug. 19 through Aug. 20, 2021, asking six different questions: (1) Where did you learn about personal finance?; (2) How much overall debt do you currently have? (Including student loan debt); (3) Do you invest your money? If so, what do you invest in? Select all that apply:; (4) If you had to pick one, what do you prioritize/value the most in a potential job?; (5) Did you move back in with your family during the coronavirus pandemic?; and (6) What do you spend the majority of your money on, aside from rent?. GOBankingRates used PureSpectrum’s survey platform to conduct the poll.